IFSC

• IFSC stands for Indian financial system code.

• It is 11 characters unique alphanumeric code (alphabets and numbers)

• It is allotted by RBI to each and every bank’s branch.

• It uniquely identifies a bank’s branch participating in any RBI regulated fund transfer system.

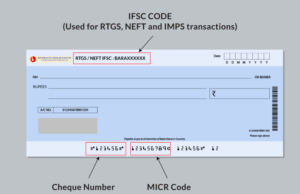

• IFSC code helps to transfer money using RTGS or NEFT or IMPS method.

• we can find IFSC code on Cheque book and on the passbook.

The following example will explain to you about IFSC code clearly

IFSC code: PUNB0160300 -> PUNB-0-160300

• PUNB-> First four characters represent bank name ( alphabets)

• 0-> It represents control number and it is same in case of all branches (zero)

• 160300-> The last 6 characters represent branch code. It is alphanumeric.

Uses

• The IFSC code is used by the NEFT system to identify the originating or destination bank or branch.

• It is also used to route the messages appropriately to the concern bank or branch.

Bank wise lists of IFSC codes with all the bank-branches participating in NEFT are available on the website of Reserve Bank Of India.

CBS

• CBS stands for CORE BANKING SOLUTION.

• CORE stands for CENTRALIZED ONLINE REAL-TIME EXCHANGE.

• It is a centralized system established by a bank which allows it’s customers to conduct their business irrespective of the bank’s branch.

• The entire range of banking products including savings, deposit accounts, etc,.. are available from any location and at any time.

• It will define the concept of “ANYWHERE, ANYTIME” banking.

• The bank buys a server and stores the information in it. And connected all it’s branches to the server, the bank branches uploads the information. So, we can use the bank facilities at any location and at any time.

• It is a networking of a bank’s branches which enable customers to operate their account from any branch of the bank on its network regardless of where they open their accounts.

• In April 2018, RBI set the deadline for Banks to integrate SWIFT with CBS to strengthen the internal control.

In the coming articles of banking series, we will be writing on RTGS, NEFT, IMPS. Also please mention in the comments what you want from us. So, that we can deliver to you that.

Subscribed to ur page providing very useful information