As we know, RBI (Reserve Bank of India) has announced INR 50,000 cr liquidity to MF’S (mutual funds).

This decision has been taken because a company (Franklin Templeton Asset Management Pvt. Ltd) which runs mutual funds has cleared INR 26,000 cr debt funds.

According to AUM (assets under management), Indians have invested a total amount of INR 15, 00,000 cr in debt funds.

Understanding the above terminology:

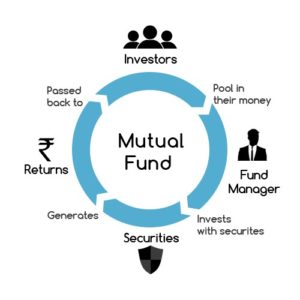

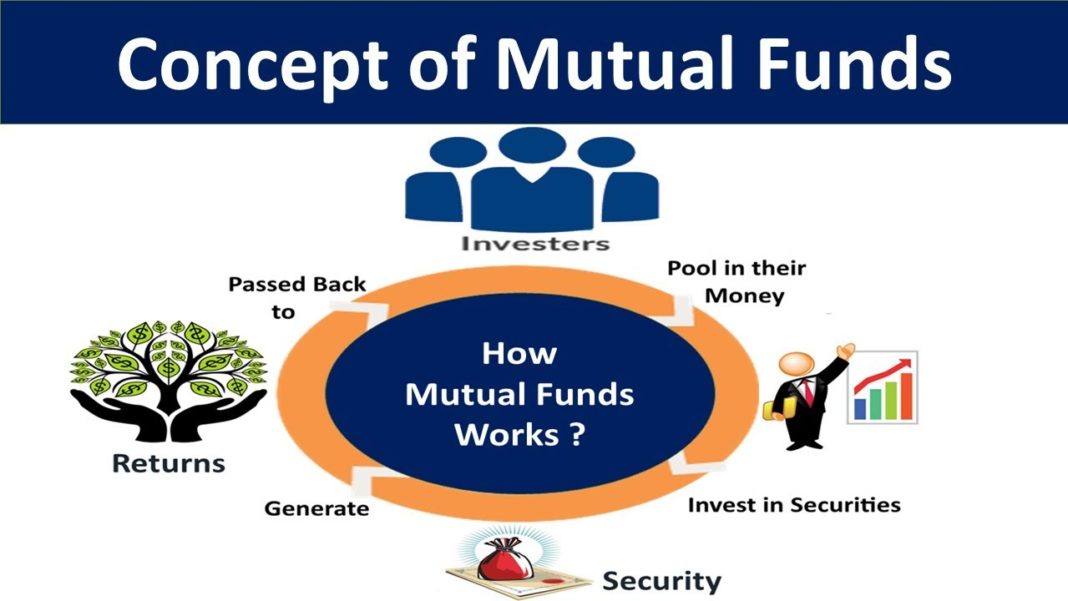

Mutual funds: Take an example; you have deposited some fixed deposit in your savings account. Bank will pay you interest either annually or monthly. In the same way, you can invest money in Mutual funds through which you will earn money.

Money earned through mutual funds is quite high compared to fixed deposits.

Q-Then the question arises, what is the security in mutual fund investment?

Ans: You will have securities in mutual funds. This will be either provided by the government or through corporate bonds.

Q-Where does a mutual fund get money from to meet earnings higher than banks?

Ans- The money lent by mutual funds are invested in companies, through which they yield profits.

Q- Why are mutual funds winding debt funds?

Ans: Simple answer- Companies are closed, no investment is no profit.

Liquidity: The money which a mutual fund requires for maintenance, salaries of their employees, redeeming their customer’s investment, transaction fees, commission payments.

Debt funds: This is almost equal to your fixed bank deposits. Wherein banks, you are charged for redeeming money within the stipulated time period. But, as far as debt funds are concerned, the depositor can redeem on any working day without charges.

Coming to the actual topic,

- Yes, RBI announced funds for liquidity. But, will RBI directly fund to Mutual funds? The answer is NO. RBI funds to bank and then Banks will fund Mutual funds as credit.

- The problem arises is, many banks in India are already in debt. They are no more interested to take it further. So, if banks are not willing to credit money to mutual funds, what makes the change with RBI’s initiative?

- RBI is cognizant of banks’ negative response in taking credits. So, they came up with some interesting norms which will persuade banking industries to lend money and credit mutual funds.

-Shivasai Bandari

If you want an article only and in-depth on mutual funds please mention in the comments.

Superb ra.

Waiting for some articles on mutual funds and share market

Need more information bro about mutual funds and stock markets

Both mutual funds and stock market returns are same??

Many plenty of question are there,

Pls give depth information

It will use us alot to make investment