Founded by Sameer Nigam, Rahul Chari, and Burzin Engineer in December 2015, PhonePe is based out of Bangalore, India. It was the first payment app to ever be launched on the Unified Payments Interface (UPI) a payment created by the National Payments Corporation of India (NPCI) for facilitating instant money transfer from one person’s bank account to another via mobile platforms.

The Vision Behind PhonePe

- When Sameer Nigam, Rahul Chari and Burzin Engineer founded PhonePe, their vision was of a financial services app that could bring the next billion Indians into the digital payments ecosystem.

- They saw the potential for UPI to democratize money for all Indians, just like the internet itself had democratized access to information. Allowing people in India to transact in a ‘grenade’, digitally – just like a text message. This perhaps was well-suited for a country where a majority of its population either remained unbanked or underbanked.

Early Development and Launch

- PhonePe materialized the day Sameer Nigam, then-Senior Vice President of Engineering at Flipkart, decided to leave Flipkart to start his venture. On board with him were Rahul Chari and Burzin Engineer bringing enormous experience in technology and finance, respectively.

- They were out to make just India’s digital payment easy. The app was officially launched in August 2016, shortly after the UPI in April of the same year.

Acquisition to Flipkart

- In April 2016, in fact, weeks before the app’s launch, PhonePe was already acquired by Flipkart—one of India’s biggest e-commerce companies. Acquiring it in a more strategic kind, this move comes as Flipkart wants to build muscle in its digital payment infrastructure to take on other bigger players in the market.

- Even post-acquisition, PhonePe continued to be an independent entity, but that reflected in the partnership with the Flipkart app aimed at leveraging the vast reach of the e-commerce giant.

- Riding on this large wave, PhonePe profited from its relatively user-friendly interface and smooth integration with UPI to turn it into a visible choice for P2P, bill payments, and online shopping.

- Growth for PhonePe actually picked up further when in November 2016, the Indian Government made a demonetisation move that resulted in a tectonic spike for digital payments as cash became scarce.

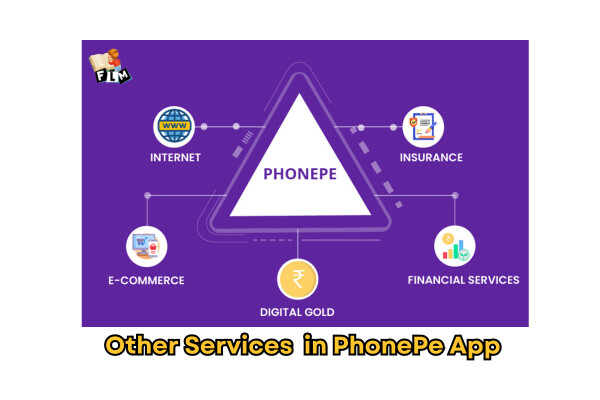

- Over the years, PhonePe expanded way beyond a money transfer platform. It started to add features for mobile, DTH, and data card recharges, pay bills for electricity, gas, and water, and even let users invest in mutual funds and buy insurance policies directly from the app.

Competitive Landscape

- PhonePe operates in one of the most challenging markets, competing with Paytm, Google Pay, and Amazon Pay. Very sharp focus on UPI and its continuous innovations in that area, apart from strategic partnerships, have been able to wrest a significant share of this market for PhonePe amidst competition.

Key Milestones

- 2017: Crossed the milestone of 10 million app downloads.

- 2018: Launched ‘PhonePe Switch,’ a one-of-its-kind platform that lets customers access various services like food delivery, travel, and shopping from partner apps without leaving the PhonePe app.

- 2019: PhonePe became the first-ever digital payments company in India to record more than 1 billion transactions in a single month across the Unified Payments Interface.

- 2020: Crossed 250 million registered users on the platform.

- 2021: With the completion of the USD 700 mn fund raise exercised by Flipkart, PhonePe became India’s most valuable fintech startup, worth USD 5.5 bln.

- 2023: The company diversified into insurance and tax-saving funds as part of its newer financial services offerings, marking just another eclectic diversification in the product bouquet. Continuous …

Present and Future

- As of December 2024, PhonePe leads digital payments across India with millions of active users and has increased its range of services. It has further focused on increasing financial services to more significant reach and coverage of smaller towns and rural areas of the country.

- This way, as digital commerce continues to transform, PhonePe will be well set on a strong path of growth, turning out to be a critical catalyst in constructing the digital payment ecosystem in India.

Conclusion:

A great deal of the PhonePe success story has much proven its innovativeness and adaptability to the fast-changing digital landscape in India. It has traversed a long way from just another simple UPI-based payment app initially to an all-inclusive financial services platform.

Written by – Arun Sai