What mutual funds actually are?

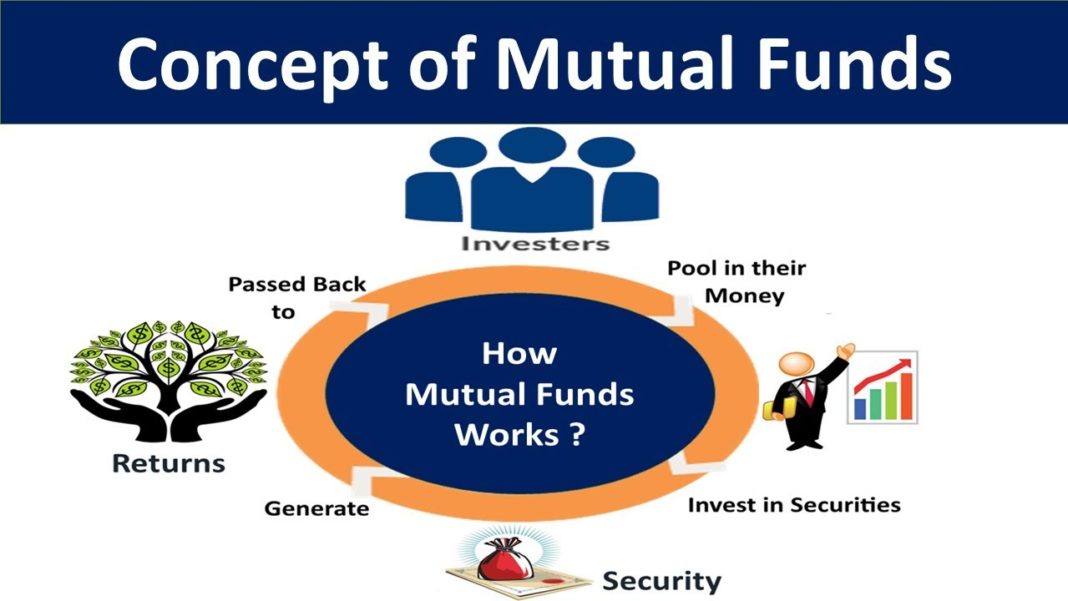

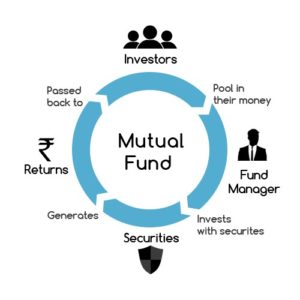

- A mutual fund is a financial product that is built to provide good returns and profits to investors.

- In mutual funds, there will be a mutual fund manager who will collect money from various investors and invest in various stocks as well as debt funds.

- It is not just one way in which the mutual fund investment happens, there are various types like equity MF’s (stocks), debt MF’s (happens with govt. sector- bonded), hybrid mutual funds(which invests in both equity & debt). We will again have various subdivisions in each category.

- Each category has a unique risk vs. return rate. Where equity MF’s have higher returns compared to debt MF’s. But then, the risk involved in equity MF’s is high.

We have trading sector, why cannot I directly invest in stocks?

- Every forward step should have careful planning and strategic implementation which yields satisfying results.

- For example, consider a situation- You neither saw sheep in your life nor known it before but, you are given a flock of sheep to graze for a week. Then the question arises, where should I take them for forage? Steppes or dense forest? Your forward step on probability may cost the lives of innocents.

- Similarly, for a person to trade in the stock market, it requires immense knowledge to come out with profits. There will be situations where you may go bankrupt.

- Here, the mutual fund manager is much known about stock investments, and selection is done very carefully by experts with extensive knowledge. MF’s allow you to invest a very small amount which is not available in stocks.

- In a stock market, the basic investment in the stock demands much high (above 50k approx.). Yes, 50k may not be a high amount to a lead businessman. But, it is to a farmer who is the majority in the Indian population.

- MF’s invest money in diverse stock markets. When a stock falls, it may be compensated by another stock that is doing well.

Are mutual funds risky?

- In the world, there is nothing that you can achieve without risk. But the risk depends. In MF’s the equity fund is riskier than a debt fund.

- But then, equity funds are less risky compared to individual stock investment. Equity funds follow the concept of diversification.

How should I select mutual funds?

- Before you select the mutual fund, shortlist the mutual fund category based on the risk involved.

- If you are a person who always wants to be on the shore, it is better to go with debt funds investment. Because it is a low-risk low return category.

- Identify your financial goal, investment duration, and target amount.

- If it is a short term financial goal, better go with low-risk low return debt funds. Because it is difficult for anyone to predict short term market.

Should I stop investing and withdraw my money when the market falls?

- You are an investor; you should have a strategic mind.

- Take the advantage of market falls down. Invest more so that, it will return you good profits in long term investments.

Should I invest mutual funds on my own or take the help of a mutual fund agent?

- Unlike stock markets, mutual fund investment does not require any masters in CA or finance.

- Understand the market with initial low investment. It may take several months of time and dedication.

- If you go by a mutual fund agent, it is again a business world that aims to make money through commissions. Initially, they may be low but, for a long term investment you will end up paying a good amount of profits to the agent.

Should I select funds based on historic returns?

- You may have known what has recently happened with a great Indian bank which was doing very well in the banking sector.

- It is the business market. Fluctuations are certain. Do not invest based on historic returns.

- A fund that has given good returns in the previous term is not guaranteed to give the same in the following term.

What is the best strategy?

- Diversification is much important in mutual funds.

- Investing 1000 INR in 4-6 mutual funds is much better than investing the whole sum in one MF.

-SHIVA SAI BANDARI