ESG & Sustainability Consulting Career Guide: The Purpose-Driven Path

Table of Contents

Climate change isn’t a distant threat anymore—it’s reshaping business strategy today. Companies face mounting pressure from investors demanding ESG (Environmental, Social, Governance) disclosures, governments enforcing carbon regulations, customers choosing sustainable brands, and employees wanting to work for responsible employers. This convergence has created one of consulting’s fastest-growing and most purpose-driven specializations: ESG and sustainability consulting.

In 2025, virtually every major company in India—from Reliance to Tata to Infosys—has committed to net-zero targets, published sustainability reports, and hired dedicated ESG teams. But most lack the expertise to measure carbon footprints, design decarbonization strategies, or navigate complex reporting frameworks. That’s where sustainability consultants come in, helping organizations transform environmental and social commitments from PR statements into measurable business strategy.cse-net+1

This guide explores what ESG consultants actually do, the technical and business skills needed, certifications that matter, salary trends, top firms building practices, and practical paths to break into this meaningful, high-growth career—whether you’re a science graduate, engineer, MBA, or traditional consultant looking to pivot.

What is ESG & Sustainability Consulting?

Understanding ESG

E – Environmental:

Climate change, carbon emissions, water usage, waste management, biodiversity, circular economy, renewable energy adoption.

S – Social:

Labor practices, diversity and inclusion, human rights, community impact, employee wellbeing, supply chain labor standards.

G – Governance:

Board composition, executive compensation, business ethics, anti-corruption, risk management, transparent reporting.

ESG is essentially how companies manage non-financial risks and opportunities that increasingly affect financial performance and stakeholder trust.cse-net+1

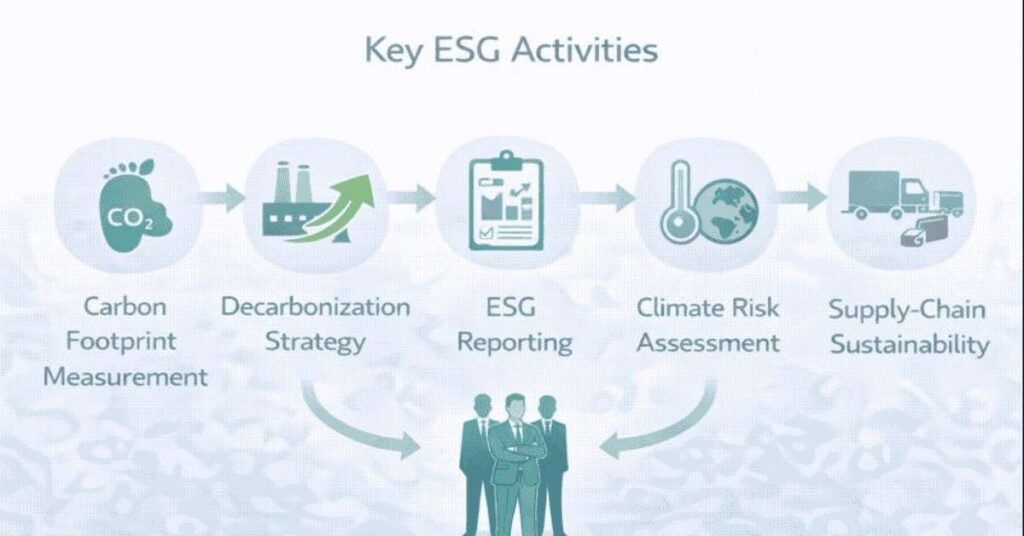

What Sustainability Consultants Do

Core activities:

- Carbon footprint measurement (Scope 1, 2, 3):

- Scope 1: Direct emissions (company vehicles, manufacturing)

- Scope 2: Indirect emissions (purchased electricity)

- Scope 3: Value chain emissions (suppliers, logistics, product use) – usually 80%+ of total

- Using tools like GHG Protocol, carbon accounting softwaredazzle-platform+1

- Scope 1: Direct emissions (company vehicles, manufacturing)

- Decarbonization strategy:

- Setting science-based targets (SBTi methodology)

- Identifying emission reduction opportunities

- Renewable energy transition planning

- Carbon offset/credit strategies

- Cost-benefit analysis of green investmentscse-net

- Setting science-based targets (SBTi methodology)

- ESG reporting and disclosure:

- Annual sustainability reports following frameworks (GRI, SASB, TCFD, CDP)

- Regulatory compliance (EU CSRD, SEBI BRSR in India)

- ESG ratings improvement (MSCI, Sustainalytics, CDP scores)

- Materiality assessments (identifying what ESG issues matter most)dazzle-platform+1

- Annual sustainability reports following frameworks (GRI, SASB, TCFD, CDP)

- Sustainable supply chain:

- Supplier ESG assessments and audits

- Sustainable sourcing strategies

- Circular economy models (reduce, reuse, recycle)

- Supply chain due diligence and transparencydazzle-platform

- Supplier ESG assessments and audits

- Climate risk assessment:

- Physical risks (extreme weather, sea-level rise affecting assets)

- Transition risks (carbon taxes, stranded assets, regulation changes)

- Scenario analysis (2°C vs 4°C warming scenarios)

- TCFD-aligned climate disclosurescse-net+1

- Physical risks (extreme weather, sea-level rise affecting assets)

- ESG strategy integration:

- Embedding sustainability into core business strategy

- Sustainable product/service innovation

- ESG governance structures

- Stakeholder engagement and communication

- Embedding sustainability into core business strategy

Why ESG Consulting is Booming

Types of ESG & Sustainability Consulting Roles

Regulatory Drivers

India:

- SEBI BRSR (Business Responsibility & Sustainability Reporting): Mandatory for top 1,000 listed companies

- Energy Conservation Act amendments: Carbon credit trading mechanism

- Plastic Waste Management Rules: Extended producer responsibility

- Companies Act CSR provisions: 2% profit spending on social initiatives

Global (affecting Indian companies):

- EU CSRD (Corporate Sustainability Reporting Directive): Affects Indian exporters to Europe

- US SEC Climate Disclosure Rules: Impacts Indian companies listed in US

- CBAM (Carbon Border Adjustment Mechanism): Carbon tax on exports to EUcse-net

Investor Pressure

- Global institutional investors (BlackRock, Vanguard) demand ESG data

- ESG ratings (MSCI, Sustainalytics) affect capital cost

- Green bonds and sustainability-linked loans require verified ESG performance

- Private equity conducting ESG due diligence on all dealsdazzle-platform

Customer & Employee Expectations

- 70% of Indian consumers prefer sustainable brands (recent surveys)

- Top talent, especially Gen Z, prioritizes working for purpose-driven companies

- B2B customers requiring supplier ESG compliance

- Brand reputation risks from ESG failures (labor issues, pollution scandals)

Business Case

- Cost savings: Energy efficiency, waste reduction, optimized resources

- Revenue growth: Green products command premium pricing

- Risk mitigation: Avoiding fines, operational disruptions, reputational damage

- Innovation catalyst: Circular economy models create new business opportunitiesdazzle-platform+1

Bottom line: ESG has moved from “nice to have” to “business critical” in 2025.

1. Carbon & Climate Consultant

Focus: Carbon accounting, net-zero strategy, climate risk

Typical projects:

- Measuring corporate carbon footprint across all three scopes

- Designing decarbonization roadmaps to achieve net-zero by 2050

- Validating Science-Based Targets (SBTi submissions)

- Climate scenario analysis and TCFD reporting

- Carbon offset project evaluationcse-net+1

Skills needed:

- Carbon accounting (GHG Protocol, ISO 14064)

- Climate science basics

- Data analysis and modeling

- Understanding of energy systems and renewable energy

- Project management for complex decarbonization programs

Who hires: BCG, EY Climate Change & Sustainability Services, Deloitte Sustainability, specialized firms like EcoAct, South Pole

2. ESG Reporting & Assurance Consultant

Focus: Sustainability reporting, ESG ratings, disclosure compliance

Typical projects:

- Producing annual sustainability reports (GRI, SASB standards)

- BRSR reporting for Indian listed companies

- CDP (Carbon Disclosure Project) submissions

- Materiality assessments (identifying key ESG topics)

- ESG data management systems implementation

- Third-party assurance of sustainability datadazzle-platform+1

Skills needed:

- Deep knowledge of reporting frameworks (GRI, SASB, TCFD, CDP, BRSR)

- ESG data collection and verification

- Stakeholder engagement

- Technical writing and communication

- Understanding of assurance standards (ISAE 3000, AA1000)

Who hires: Big 4 (all have large ESG assurance practices), KPMG Impact, specialized ESG firms

3. Sustainable Supply Chain Consultant

Focus: Supplier sustainability, circular economy, responsible sourcing

Typical projects:

- Supplier ESG risk assessments and scorecards

- Ethical sourcing programs (conflict minerals, labor standards)

- Circular economy strategy (product design for recycling, reverse logistics)

- Supply chain transparency and traceability solutions

- Sustainable packaging designdazzle-platform

Skills needed:

- Supply chain management knowledge

- Life cycle assessment (LCA) methodology

- Circular economy principles

- Supplier audit and risk assessment

- Understanding of social compliance standards (SA8000, SMETA)

Who hires: McKinsey Sustainability, BCG, Accenture Sustainability Services, specialized firms

4. ESG Strategy & Transformation Consultant

Focus: Integrating ESG into business strategy, organizational change

Typical projects:

- ESG materiality and strategy development

- Purpose and values definition

- ESG governance structure design (board committees, management roles)

- Sustainable business model innovation

- ESG-linked executive compensation design

- Stakeholder engagement strategiescse-net

Skills needed:

- Strategic thinking and business acumen

- Change management

- Stakeholder management

- ESG trend analysis

- Communication and influence

Who hires: MBB firms (strategy-focused ESG), Big 4, specialized strategy boutiques

5. Green Finance & Investment Consultant

Focus: ESG investing, green bonds, impact measurement

Typical projects:

- ESG integration in investment processes

- Green bond framework development

- Impact measurement and reporting for social/green investments

- ESG due diligence for M&A

- Sustainable finance product designdazzle-platform

Skills needed:

- Finance and investment knowledge

- ESG rating methodologies

- Impact measurement frameworks (IRIS+, SASB)

- Green bond standards (Climate Bonds Initiative)

- Financial modeling

Who hires: PwC Sustainable Finance, EY, KPMG, investment banks with ESG arms

Essential Skills for ESG Consulting Success

Technical ESG Skills

Must-have:

- Carbon accounting: GHG Protocol, Scope 1/2/3 calculation methodologiescse-net+1

- Reporting frameworks: Working knowledge of GRI, SASB, TCFD, CDP, BRSRcse-net+1

- ESG data analysis: Excel modeling, data visualization, ESG software platforms

- Climate science basics: Understanding warming scenarios, climate impacts, mitigation vs adaptation

- Regulatory knowledge: Key ESG regulations in India and globallycse-net

Nice-to-have:

6. Life cycle assessment (LCA): Measuring environmental impact across product lifecycle

7. Renewable energy knowledge: Solar, wind, green hydrogen technologies

8. Social impact measurement: Theory of change, impact metrics

9. Biodiversity and nature: TNFD (Taskforce on Nature-related Financial Disclosures)

10. ESG tech platforms: Sustainalytics, MSCI ESG Manager, carbon accounting softwaredazzle-platform

Business & Soft Skills

- Strategic thinking: Connecting ESG to business value, not just compliance

- Stakeholder management: Working with CFOs, operations, procurement, communications

- Change management: ESG transformation requires cultural change

- Communication: Translating technical ESG concepts to executives

- Project management: Multi-workstream sustainability programs

- Influencing: Building internal buy-in for ESG initiativesdazzle-platform+1

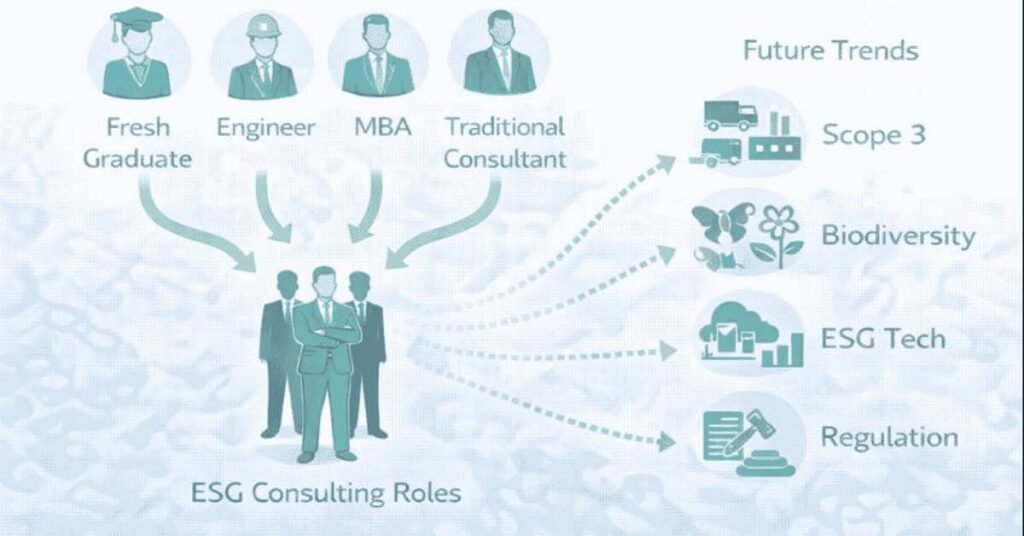

Learning Paths by Background

Science/Environmental background:

- Your edge: Climate science, environmental knowledge

- Gap: Business strategy, finance, stakeholder management

- Focus: Learn business fundamentals, take strategy courses, practice business communication

Engineering background:

- Your edge: Technical analysis, process optimization

- Gap: ESG frameworks, sustainability context

- Focus: Get ESG certifications (CESGA, GRI), read sustainability reports, understand carbon accountingcse-net+1

Business/MBA background:

- Your edge: Strategy, finance, management

- Gap: Technical ESG knowledge

- Focus: Deep-dive on carbon accounting, reporting frameworks, climate science fundamentalscse-net

Traditional consulting background:

- Your edge: Client management, frameworks, project delivery

- Gap: ESG domain expertise

Focus: Get certified (CFA ESG, CESGA), work on ESG projects, network with sustainability teams

Key Certifications That Matter

1. Certified ESG Analyst (CESGA) – CFA Institute

What it covers: ESG integration, portfolio construction, risk analysis, reporting

Duration: 130 hours study, one exam

Cost: ~$600 (₹50,000)

Value: Strong for investment-focused roles, recognized globally

Best for: Finance backgrounds entering ESG investingcse-net

2. GRI Certified Sustainability Professional

What it covers: GRI reporting standards, materiality, stakeholder engagement, assurance

Duration: Training + exam

Cost: ~€1,000 (₹90,000)

Value: Essential for reporting-focused roles

Best for: Those focusing on sustainability reporting and disclosuredazzle-platform+1

3. LEED Green Associate / LEED AP

What it covers: Green building design, energy efficiency, sustainable construction

Duration: 10-20 hours prep, exam

Cost: $250-450 (₹20,000-37,000)

Value: Useful for real estate, construction, built environment consulting

Best for: Engineers, architects, real estate professionals

4. Carbon Literacy Certification

What it covers: Carbon footprint basics, personal and organizational action

Duration: 1 day training + assessment

Cost: £250-500 (₹26,000-52,000)

Value: Good foundation, not deep expertise

Best for: Beginners wanting credibility

5. ISO 14001 Lead Auditor (Environmental Management)

What it covers: Environmental management systems, compliance auditing

Duration: 5-day course + exam

Cost: ₹30,000-60,000

Value: Strong for manufacturing, operations consulting

Best for: Those focusing on environmental compliance and management systems

6. Climate Change and Business Strategy (Harvard Business School Online)

What it covers: Climate risks, decarbonization strategy, sustainable business models

Duration: 6-8 weeks online

Cost: ~$1,600 (₹1.3 lakh)

Value: Prestigious, strategy-focused

Best for: Senior professionals, those targeting strategy rolescse-net

7. Science-Based Targets (SBTi) Learning Course

What it covers: Setting and validating science-based climate targets

Duration: Self-paced online

Cost: Free

Value: Practical for carbon target-setting projects

Best for: Climate consultants working on net-zero strategiesdazzle-platform+1

Recommendation: Start with one foundation certification (CESGA or GRI) + one specialized based on your focus area (carbon, reporting, or finance).

ESG Consulting Salaries in India

ESG consultants earn comparable to traditional consulting at entry/mid-levels, with premiums at senior levels due to expertise scarcity.jaroeducation+1

Entry-Level (0-2 Years)

ESG Analyst / Associate:

- Big 4 ESG practices: ₹8-14 LPA

- MBB sustainability practices: ₹18-24 LPA

- Specialized ESG firms: ₹10-16 LPA

- NGOs/Impact orgs: ₹6-10 LPA (lower pay but mission-driven)jaroeducation

Mid-Level (3-7 Years)

ESG Consultant / Manager:

- Big 4: ₹18-32 LPA

- MBB: ₹35-55 LPA

- Specialized firms: ₹22-38 LPA

- Corporate ESG Manager (exit option): ₹25-45 LPAjaroeducation

Senior Level (8+ Years)

ESG Senior Manager / Director:

- Big 4 Partners: ₹50-90 LPA

- MBB Partners: ₹1-2+ Cr

- Specialized boutique founders: ₹40-80 LPA + profit share

- Chief Sustainability Officer (corporate): ₹60 LPA – 1.5 Crjaroeducation

Salary influencers:

- Certifications (CESGA, GRI add 10-15% premium)

- Technical depth (carbon accounting specialists earn more)

- Industry (finance, energy pay more than retail, manufacturing)

City (Mumbai, Bengaluru pay 15-20% more than Tier 2 cities)

Top Firms Hiring for ESG & Sustainability Consulting

MBB Sustainability Practices

- BCG Climate & Sustainability

- Largest sustainability practice among MBB

- Focus: Decarbonization, circular economy, sustainable finance

- Hiring: Strategy consultants + ESG specialists

- Comp: Standard BCG rates (₹20-26 LPA entry)

- McKinsey Sustainability

- Integrated into core practice

- Focus: Climate tech, nature, sustainable transformation

- Hiring: Generalist consultants with sustainability passion

- Comp: Standard McKinsey (₹22-28 LPA entry)

- Bain Sustainability & Responsibility

- Smaller but growing practice

- Focus: Social impact, responsible business

- Hiring: Consultants with impact sector experience

Big 4 ESG Powerhouses

- EY Climate Change & Sustainability Services (CCaSS)

- One of largest ESG practices globally

- Focus: Carbon, reporting, assurance, sustainable finance

- Hiring: Environmental scientists, engineers, accountants

- Comp: ₹10-15 LPA entryjaroeducation

- Deloitte Sustainability & Climate

- Integrated ESG across all service lines

- Focus: BRSR reporting, net-zero strategy, ESG tech

- Hiring: Diverse backgrounds with ESG certifications

- KPMG Impact (formerly Sustainability)

- Strong ESG assurance and reporting practice

- Focus: ESG data, ratings improvement, impact measurement

- Hiring: Accountants transitioning to ESG, sustainability graduates

- PwC ESG

- Focus: Sustainable finance, ESG reporting, climate risk

- Strong in TCFD and climate scenario analysis

- Hiring: Finance + sustainability backgrounds

Specialized ESG Firms

- ERM (Environmental Resources Management)

- Global leader in environmental consulting

- Focus: Environmental compliance, EIA, due diligence

- Strong in industrial/manufacturing sectors

- South Pole / EcoAct

- Carbon specialists

- Focus: Carbon footprint, offsets, net-zero strategy

- Hiring: Climate scientists, carbon analysts

- Sustainalytics (Morningstar)

- ESG ratings and research

- Focus: ESG data, ratings methodology

- Hiring: Analysts with finance + ESG knowledgedazzle-platform+1

- CDP (formerly Carbon Disclosure Project)

- Environmental disclosure system

- Focus: Climate, water, forests reporting

- Mission-driven, lower pay, high impact

How to Break Into ESG Consulting

Path 1: Fresh Graduate (Any Background)

Timeline: 6-12 months prep

- Foundation learning (Months 1-3):

- Take “Sustainability and Business” course (Coursera)

- Read 10+ sustainability reports (Tata, Infosys, Unilever, Patagonia)

- Follow: GreenBiz, Sustainability Magazine, CDP reports

- Take “Sustainability and Business” course (Coursera)

- Certification (Months 4-6):

- Get Carbon Literacy or start CESGA/GRI certification

- Take free SBTi course

- Get Carbon Literacy or start CESGA/GRI certification

- Practical experience (Months 6-9):

- Volunteer: Calculate personal/college/NGO carbon footprint

- Internship: Apply to Big 4 ESG practices, specialized firms

- Project: Analyze a company’s ESG performance, write mock report

- Volunteer: Calculate personal/college/NGO carbon footprint

- Job applications (Months 9-12):

- Target: Big 4 ESG (high volume hiring), specialized firms

- Resume: Highlight certifications, projects, genuine passion

- Interview prep: Know GRI, TCFD, SBTi, current ESG trendsdazzle-platform+1

- Target: Big 4 ESG (high volume hiring), specialized firms

Path 2: Science/Engineering Background → ESG

Your advantage: Technical credibility, analytical skills

Action plan:

- Get business context: MBA/Executive program or business strategy courses

- Certifications: CESGA (for credibility), GRI (for practical knowledge)

- Transition roles: Environmental compliance → ESG consulting; Energy consulting → Climate consulting

- Target firms: ERM, EY CCaSS, specialized environmental firmsdazzle-platform

Path 3: Traditional Consulting → ESG Pivot

Your advantage: Client management, frameworks, delivery

Action plan:

- Internal transfer: Volunteer for ESG projects at your firm, express interest to practice leads

- Get certified: CESGA or GRI while doing regular projects

- Build expertise: Read voraciously, attend conferences, network

- Lateral move if needed: Use consulting brand to move to ESG practice elsewhere

- Position yourself: “Strategy consultant with ESG specialization”cse-net

Path 4: Corporate → ESG Consulting

Your advantage: Industry depth, operational knowledge

Action plan:

- Build ESG credentials in current role: Lead sustainability initiatives, BRSR reporting

- Get certified: Shows commitment to career change

- Network: Connect with ESG consultants, attend sustainability events

- Transition story: “I want to drive ESG impact across multiple industries, not just one company”

- Target: Firms needing industry specialists (e.g., manufacturing expert for industrial sustainability)

Challenges & Realities of ESG Consulting

The Good

✅ Meaningful work: Genuine impact on climate and society

✅ Future-proof: ESG demand only growing

✅ Intellectual stimulation: Complex, interdisciplinary problems

✅ Variety: Different industries, ESG topics, stakeholders

✅ Values alignment: Work matches personal values for many

✅ Growing field: Lots of room for innovation and thought leadershipcse-net+1

The Challenges

❌ Greenwashing concerns: Some projects feel more PR than substance

❌ Data quality issues: Poor ESG data makes analysis frustrating

❌ Slow change: Corporate transformation takes years, not months

❌ Lower pay than tech consulting: (though improving)

❌ Newer practice area: Less structured career paths than traditional consulting

❌ Client resistance: Some view ESG as cost, not opportunity

❌ Constantly evolving regulations: Hard to keep up with changing rules

Future of ESG Consulting: What's Coming

Trends to Watch (2025-2030)

- Scope 3 explosion: Companies finally tackling complex supply chain emissionsdazzle-platform+1

- Nature/biodiversity: TNFD reporting becoming as important as TCFD

- Just Transition: Ensuring climate action doesn’t harm workers/communities

- ESG tech: AI-powered ESG data collection, blockchain for supply chain transparency

- Regulation tsunami: More mandatory ESG disclosure globallycse-net

- Integration: ESG moving from separate function to core strategy

- Social > Environment: More focus on social issues (DEI, labor, human rights) catching up to climate

Career implication: Early specialists in these emerging areas will command premium positions.

Final Thoughts: Purpose + Pay

ESG consulting offers a rare combination: doing work that matters while building a solid, well-paid career. It’s not charity—companies need ESG expertise for competitive survival. But unlike selling widgets or optimizing ad clicks, you’re helping businesses operate more responsibly and sustainably.

If you care about climate, social justice, or ethical business AND you want consulting’s intellectual challenge and career growth, ESG consulting might be your perfect path. The field is young enough that you can still become a recognized expert within 5-7 years of focused effort.

The planet needs more smart, capable people solving sustainability challenges. Why not get paid well to do it?