ESG Analyst Career Guide: Skills, Salary & How to Become One

Table of Contents

Introduction

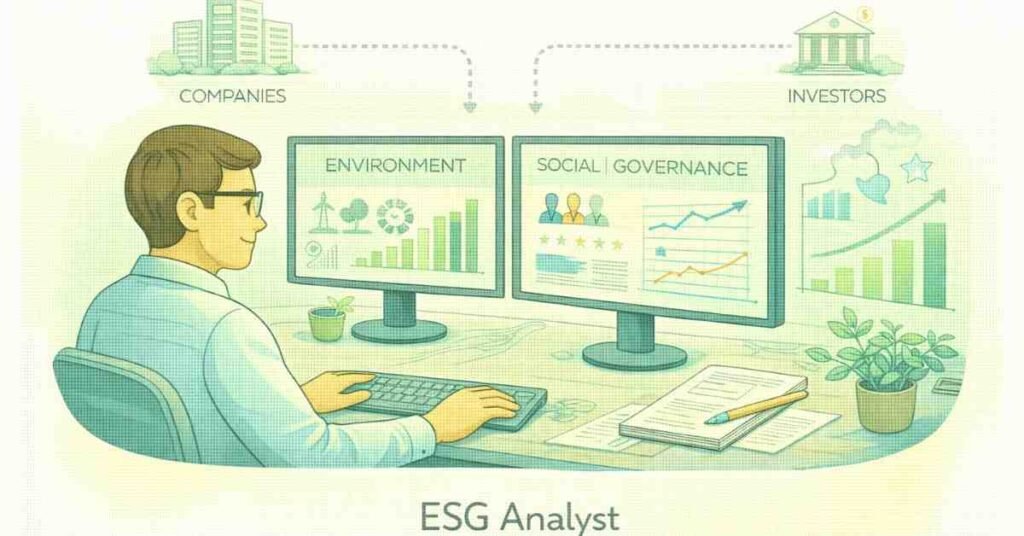

ESG analysts are at the heart of a major shift in how businesses operate and how investors decide where to put their money. ESG stands for Environmental, Social, and Governance. It is a way to measure how responsibly a company behaves towards the planet, people, and ethical business practices. Companies and investors now look beyond profit and want to know: “Is this business sustainable and well-governed?

As an ESG analyst, your job is to collect, study, and interpret this kind of information and turn it into clear insights that support investment decisions, sustainability strategies, and corporate reporting. It is a great option if you like a mix of environment, business, data, and impact.

What Does an ESG Analyst Do?

An ESG analyst studies how a company performs on three pillars:

- Environmental: carbon emissions, pollution, waste, water use, energy use, renewable energy adoption.

- Social: employee welfare, diversity and inclusion, health and safety, community impact, human rights in the supply chain.

- Governance: board structure, transparency, ethics, anti-corruption, shareholder rights.

In simple terms, you look at:

- How a company treats the planet,

- How it treats people, and

- How honestly and responsibly it is managed.

Typical Daily Tasks

- Collect data from annual reports, sustainability reports, CSR reports, company websites, and databases.

- Check whether a company follows ESG frameworks like GRI, SASB, or India’s BRSR (Business Responsibility and Sustainability Reporting).

- Score or rate companies on ESG performance for investors or rating systems.

- Prepare ESG reports, dashboards, and summaries for internal teams or clients.

- Track ESG-related news about companies, regulations, and global trends.

You spend a lot of time working with documents, spreadsheets, and tools—less fieldwork, more analysis and interpretation. This role is ideal if you enjoy research, structured thinking, and explaining complex topics clearly.

Where Do ESG Analysts Work?

ESG roles have grown quickly because investors, regulators, and customers are pushing companies to be more transparent and responsible. Many types of organizations now hire ESG analysts:

- Investment firms and asset managers – to decide which companies to invest in based on ESG risk and performance.

- Banks and financial institutions – for sustainable finance, green bonds, and ESG risk teams.

- Big 4 and consulting firms – EY, Deloitte, PwC, KPMG and others have ESG and sustainability advisory practices.

- ESG rating agencies and research companies – that rate companies for investors.

- Large corporates – in sustainability, investor relations, or CSR teams to handle reporting and ESG strategy.

Because ESG is global, many skills in this role can later be used for opportunities outside India as well.

Skills Required to Become a Strong ESG Analyst

You don’t need to be a climate scientist or a finance expert from day one, but you do need a mix of technical, business, and soft skills.

Technical Skills

- Data Analysis and Excel

- Handling large sets of company data in spreadsheets.

- Using formulas, pivot tables, charts, and dashboards for insights.

- Handling large sets of company data in spreadsheets.

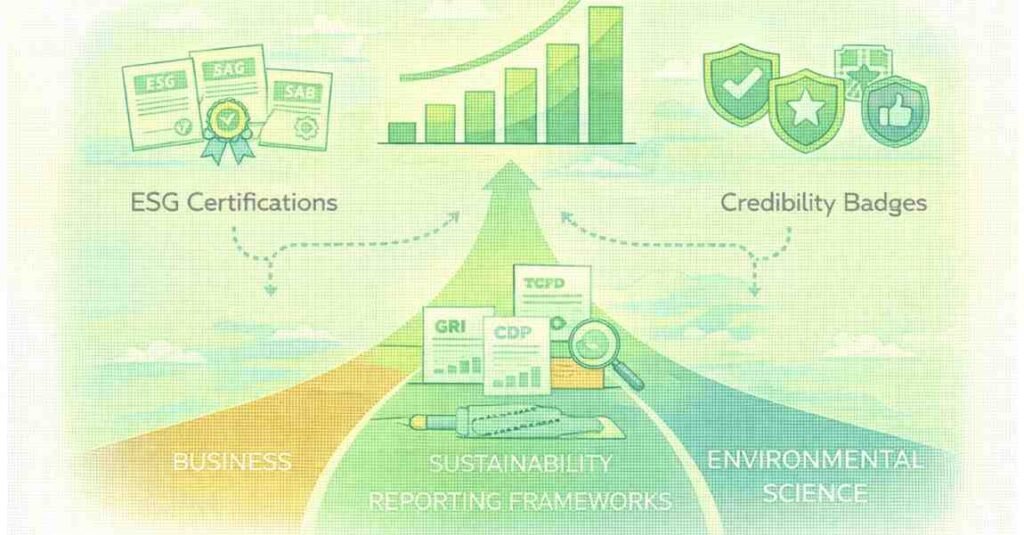

- Understanding ESG Frameworks and Standards

- GRI (Global Reporting Initiative), SASB, TCFD, CDP, and India’s BRSR.

- Knowing what kind of data each framework expects and how companies disclose it.

- GRI (Global Reporting Initiative), SASB, TCFD, CDP, and India’s BRSR.

- Basic Finance and Business Understanding

- Reading balance sheets and annual reports at a basic level.

- Understanding how ESG risks can affect business value and reputation.

- Reading balance sheets and annual reports at a basic level.

- Environmental and Social Concepts

- Carbon footprint, climate risk, pollution, biodiversity basics.

- Human rights, labour practices, health and safety, diversity and inclusion.

- Carbon footprint, climate risk, pollution, biodiversity basics.

- Reporting and Documentation

- Structuring ESG reports, company profiles, and investment memos.

- Writing in a clear, concise, and neutral tone.

- Structuring ESG reports, company profiles, and investment memos.

Soft Skills

- Critical Thinking

- Looking beyond what the company claims and checking the quality of data.

- Identifying greenwashing (when companies exaggerate their sustainability claims).

- Communication Skills

- Explaining ESG findings to non-experts like managers, investors, or clients.

- Presenting complex data in a simple, visual way.

- Attention to Detail

- Spotting errors, inconsistencies, or missing information in reports.

- Curiosity and Continuous Learning

- ESG is a fast-changing space; policies, expectations, and practices keep evolving.

Educational Path to Become an ESG Analyst

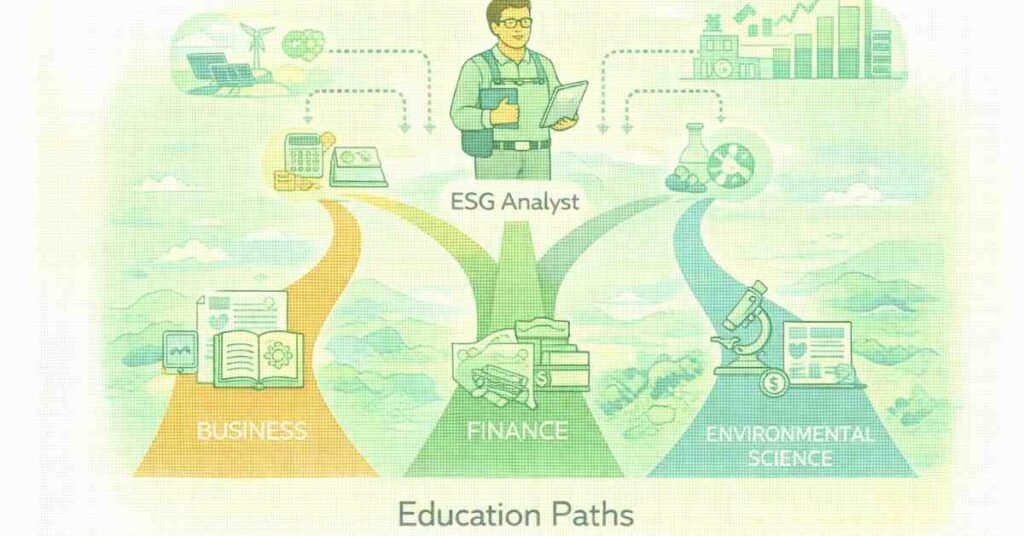

There is no single compulsory degree, which makes ESG accessible from multiple backgrounds. What matters is that you understand both sustainability concepts and basic business/finance language.

Recommended Undergraduate Degrees

Good starting points include:

- BCom, BBA, BA in Economics, or Finance-related degrees – stronger on business and finance.

- BSc Environmental Science, Life Sciences, or related – stronger on environmental and scientific aspects.

- BE/BTech – especially if combined later with a sustainability or management degree.

Any of these can work if you consciously build the missing half:

- Business students should learn environmental and social topics.

- Science/engineering students should learn finance and corporate reporting basics.

Postgraduate Options (Useful, but Not Mandatory)

- MBA in Sustainability / ESG / Responsible Management – ideal if you want senior roles in corporates or consulting.

- MSc in Environmental Management / Sustainability / Climate Change – ideal if you want to bring deep environmental knowledge into corporate ESG work.

Shorter postgraduate diplomas and executive programs in ESG/sustainability are also helpful for working professionals shifting into this space.

Certifications That Help in ESG Careers

Even without tools access, it is widely known in the industry that certain credentials boost credibility and help you stand out when applying for ESG roles.

Popular options include:

- ESG-focused certificates from global finance or sustainability bodies.

- Sustainability and climate courses from reputable universities and platforms.

- Reporting framework certifications (for example, training in GRI Standards).

You don’t need all of them. One or two well-chosen certifications aligned with your career stage are enough to signal seriousness and knowledge.

ESG Analyst Salary in India (Realistic View)

Exact numbers vary by company, city, and your background, but ESG roles are generally better-paying than many traditional environmental positions because they sit close to business and finance.

Typical ranges:

- Entry-level ESG / Sustainability Analyst (0–2 years):

Roughly around the mid single-digit to low double-digit lakhs per year in large cities, depending on employer type and your academic background. - Mid-level ESG Analyst / Senior Analyst (3–6 years):

Often into higher double-digit ranges as you take on more responsibility, especially in large corporations, consulting, or financial firms. - Senior ESG Manager / Head of ESG (7+ years):

Compensation can rise significantly, particularly in multinational firms and at the intersection of ESG and investment decisions.

In short: compared with many pure environmental technical roles, ESG analysts tend to have stronger earning potential because their work directly influences risk, reputation, and investment decisions.

Step-by-Step Roadmap to Become an ESG Analyst

Step 1: Build Your Foundation (Student Phase)

- Choose an undergraduate degree that gives you either a business/finance or environmental base.

While studying, take elective subjects or online courses in the other side (for example, finance students learn climate and sustainability, science students learn accounting basics).

Step 2: Learn the Language of ESG

- Read a few annual reports and sustainability reports of large companies to understand how they talk about ESG.

- Learn core concepts: carbon emissions, net-zero, diversity metrics, board independence, codes of conduct, etc.

Follow ESG and sustainability news to stay updated.

Step 3: Get Practical Exposure

- Aim for internships in:

- Corporate sustainability or CSR teams.

- Consulting firms with ESG/sustainability projects.

- Research or rating organizations working on ESG topics.

- Corporate sustainability or CSR teams.

Even if your initial work is basic (data entry, documentation), it gives you exposure to real ESG workflows.

Step 4: Develop Data and Reporting Skills

- Become comfortable with Excel and, if possible, basic BI tools (like simple dashboards).

- Practice converting raw data into clean tables, charts, and short written insights.

Learn how ESG reports are structured and what investors care about.

Step 5: Add a Relevant Certification

- Choose one good ESG or sustainability certification aligned with your profile and budget.

- Use it as a structured way to learn frameworks, case studies, and best practices.

Step 6: Build a Portfolio

- Create 2–3 sample ESG analyses or mini case studies:

- Example: Compare two companies in the same sector on their environmental and social performance using publicly available reports.

- Summarize findings in a short PDF or slide deck.

- Example: Compare two companies in the same sector on their environmental and social performance using publicly available reports.

This gives you concrete material to talk about in interviews and shows initiative.

Step 7: Apply Strategically

- Target roles with titles like:

- ESG Analyst

- Sustainability Analyst

- Responsible Investment Analyst

- Sustainability Reporting Associate

- ESG Analyst

- Tailor your resume to highlight:

- ESG-relevant projects and internships.

- Any climate, sustainability, or finance coursework.

- ESG-relevant projects and internships.

Certifications and tools (Excel, reporting frameworks).

Sample Interview Themes for ESG Analyst Roles

You can expect questions in these areas:

- Basics of ESG:

- What does ESG mean?

- Why is ESG important for investors and companies?

- Environmental Topics:

- What is a carbon footprint?

- What is the difference between Scope 1, 2, and 3 emissions?

- Social & Governance Topics:

- Examples of social risks in a company.

- Why is board independence important in governance?

- Analytical Skills:

- How would you compare two companies on ESG using public data?

- How would you handle missing or inconsistent data?

- Mindset and Motivation:

- Why do you want to work in ESG instead of a traditional finance or environmental job?

- How do you stay updated on ESG regulations and trends?

Is ESG Analysis the Right Career for You?

You are likely to enjoy and grow in ESG if:

- You care about environment and society but also like business and numbers.

- You enjoy reading, research, and making sense of complex information.

- You are comfortable working with documents, spreadsheets, and reports instead of heavy fieldwork.

- You want a career that has both impact and good earning potential.

For students coming from environmental science or engineering, ESG offers a bridge into corporate and financial worlds. For business, commerce, or economics graduates, ESG offers a way to work with purpose while still staying close to mainstream business careers.