Online Payment Process

Electronic fund transfer is a system of transferring money from one bank account directly to another without any paper money changing hands. It is done via computers without the direct intervention of bank staff.

PAYER ——> NETWORK —–> PAYEE

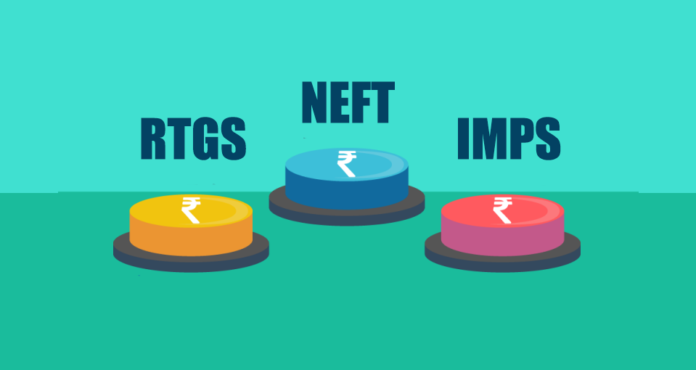

There different methods to transfer money via networks. They are RTGS, NEFT, IMP…

RTGS Payment Process

RTGS stands for REAL TIME GROSS SETTLEMENT. It is an electronic form of funds transfer, where the transmission takes place on a real-time basis. It is maintained by RESERVE BANK OF INDIA established in March 2004.

In INDIA transfer of funds, RTGS is done for high-value transactions. The minimum amount being is 2 lakh rupees. The beneficiary account receives the funds transferred, on a real-time basis. The fund transfer happens immediately, in real-time. Instructions are processed at the time they received rather than later. The gross settlement means the settlement of funds transfer occurs on instruction by instruction. We can transfer money by using RTGS from 7:00 am to 6:00 pm on the bank’s working days.

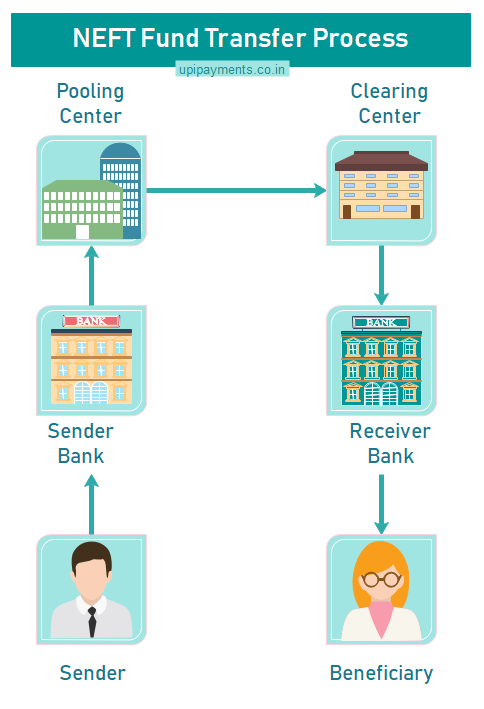

NEFT Payment Process

NEFT stands for NATIONAL ELECTRONIC FUNDS TRANSFER. It is an electronic funds transfer system maintained by RESERVE BANK OF INDIA started in November 2005, the setup was established and maintained by INSTITUTE FOR DEVELOPMENT AND RESEARCH IN BANKING TECHNOLOGY (IDRBT).

NEFT enables bank customers in India to transfer funds between any two NEFT- enabled bank accounts on a one – to- one basis. It is done via electronic messages. Unlike RTGS, fund transfer through in NEFT system do not occur on a real-time basis. NEFT settles fun transfer in half-hourly batches with 23 settlements occurring between 8:00 am and 6:00 pm on weekdays and the first and third and fifth Saturday of the calendar month. A transfer initiated outside this time period are settled at the next available window. No settlements are made on the second and fourth Saturday of the month, or on Sundays, or on public holidays.

IMPS Payment Process

IMPS stands for IMMEDIATE PAYMENT SERVICE. It is an instant payment inter-bank electronic fund transfer system in India. IMPS. Offers interbank electronic fund transfer service through mobile phone. Unlike NEFTand RTGS, the service is available 24/7 throughout the year including bank holidays. It is managed by the NATIONAL PAYMENT CORPORATION OF INDIA (NPCI) and it is built upon the existing national financial switch network.

In 2010, the NPCI initially carried out a pilot for the mobile payment system with 4 member banks (SBI, Bank of India, Union Bank of India, ICICI bank) and expanded it to include YES Bank, AXIS Bank, and HDFC bank later that year. IMPS was publicly launched on November 22, 2010. Currently, there 53 commercial banks, 101 rural/district/Urban and cooperative bank’s and 24 PPLI signed up for the IMPS service. The apps that you are using now as the phone pay, Gpay, UPI comes under the IMPS mode of transactions. The banks here act as the gateways.

– Ranjit Kalivarapu

(Editor in Chief Frontlinesmedia)

Bro recent news is that NEFT is available for 24/7