Accounting & Audit Careers

Table of Contents

Why Accounting? The Universal Finance Skill

Here’s something most people don’t realize: accounting is the foundation of every finance role. Whether you become an investment banker, CFO, or financial analyst, you’ll use accounting principles daily.

Think of accounting as the language of business. Just like you need to know English to communicate, you need to know accounting to understand how businesses make and lose money.

The best part? Accounting skills are universal—you can work in any industry, any country, anywhere. A Chartered Accountant (CA) from India can work in the US, UK, Singapore, or Dubai with the right certifications.

What Do Accountants Actually Do?

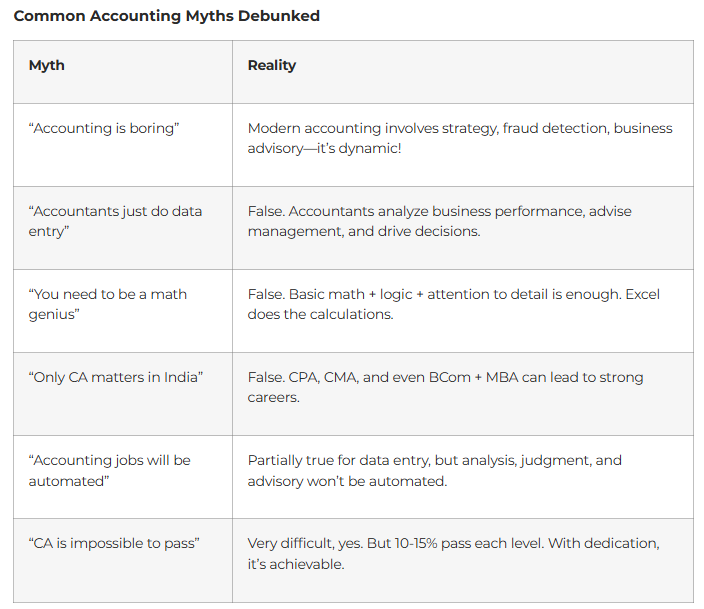

Let’s bust the myth: Accounting is NOT just “adding and subtracting numbers all day.”

Modern accountants:

- Analyze business performance and identify trends

- Advise management on financial decisions

- Ensure companies follow tax laws and regulations

- Detect fraud and financial irregularities

- Create financial strategies for growth

- Use technology (ERP systems, AI tools, automation)shiksha

Simple analogy: If a company is like a car, accountants are the mechanics who make sure the engine (finances) runs smoothly, diagnose problems, and prevent breakdowns.

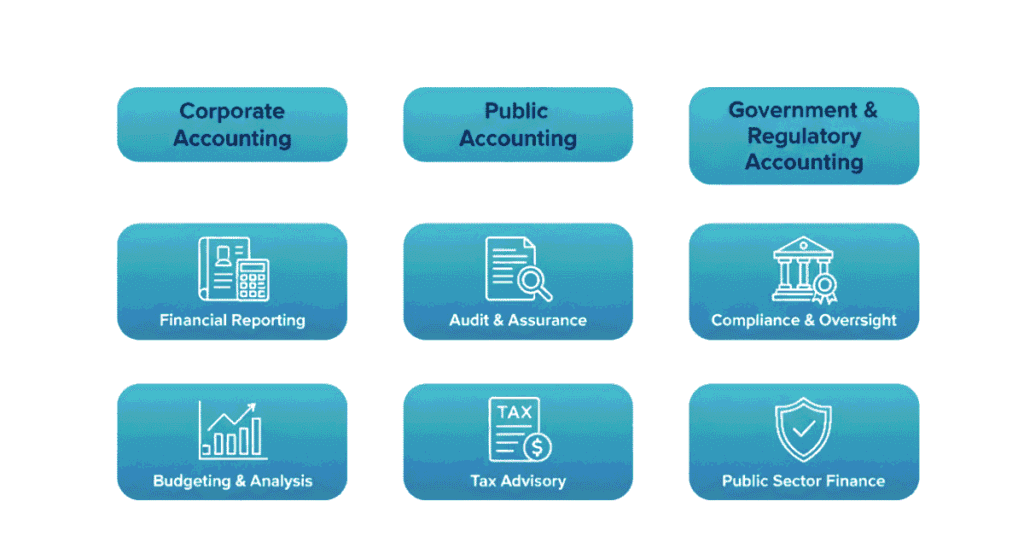

Three Main Accounting Career Paths

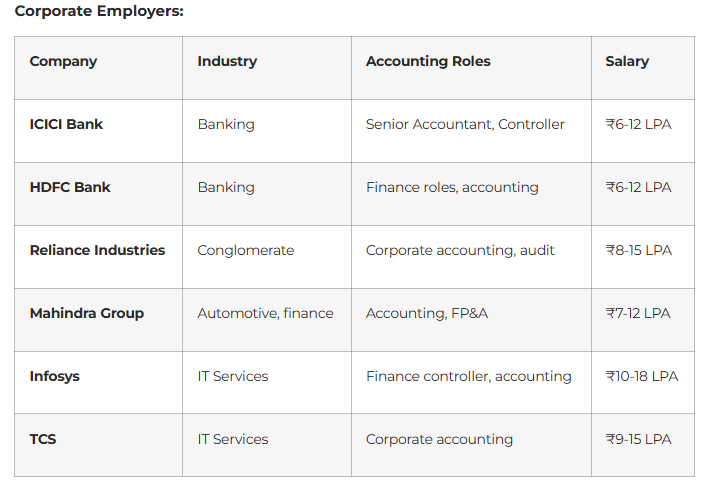

- Corporate Accounting (Working Inside Companies)

What they do:

- Record all financial transactions

- Prepare financial statements (balance sheet, profit & loss, cash flow)

- Manage payroll, taxes, budgets

- Ensure compliance with regulations

- Advise management on financial decisions

Where they work:

- Every company needs accountants: IT firms, manufacturing, retail, startups, banks, hospitals

- Top employers: ICICI, HDFC, Reliance, Mahindra, TCS, Infosys

Career progression:

- Junior Accountant (₹2-4 LPA) → Senior Accountant (₹4-7 LPA) → Accounting Manager (₹7-12 LPA) → Finance Controller (₹15-30 LPA) → CFO (₹50+ LPA)

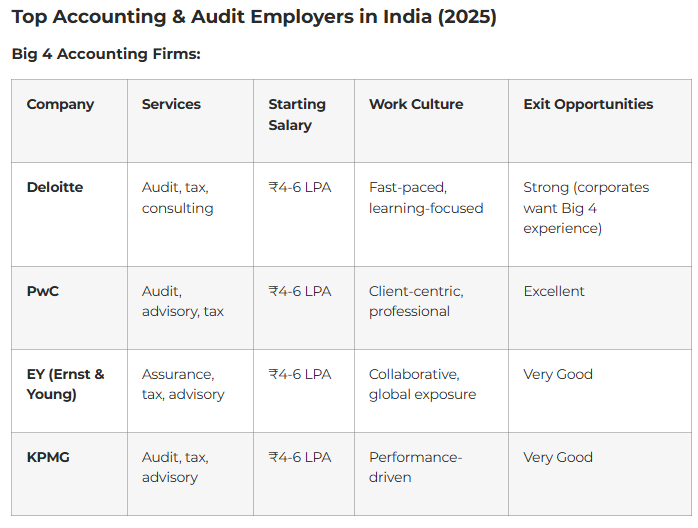

- Public Accounting (Working at Accounting Firms)

What they do:

- Provide accounting services to multiple clients

- Conduct audits (verify financial accuracy)

- Prepare tax returns and tax planning

- Offer consulting on financial matters

- Help companies during IPOs, mergers, acquisitions

Where they work:

- Big 4 firms: Deloitte, PwC, EY, KPMG

- Mid-tier firms: Grant Thornton, BDO, RSM

- Small local accounting firms

Why it’s appealing:

- Exposure to multiple industries and companies

- Faster learning (you see different business models)

- Strong career progression

- Prestigious firms on your resume

Career progression:

- Associate/Analyst (₹3-5 LPA) → Senior Associate (₹5-8 LPA) → Manager (₹10-18 LPA) → Senior Manager (₹18-30 LPA) → Partner (₹50+ LPA)

- Government & Regulatory Accounting

What they do:

- Work for government agencies (RBI, SEBI, Income Tax Department)

- Ensure companies follow regulations

- Investigate financial crimes and tax evasion

- Set accounting standards and policies

Where they work:

- Reserve Bank of India (RBI)

- Securities and Exchange Board of India (SEBI)

- Comptroller and Auditor General (CAG)

- Income Tax Department

Why consider it:

- Job security (government positions are stable)

- Good work-life balance

- Pension benefits

- Prestigious roles

Salary: ₹6-12 LPA (varies by department and experience)

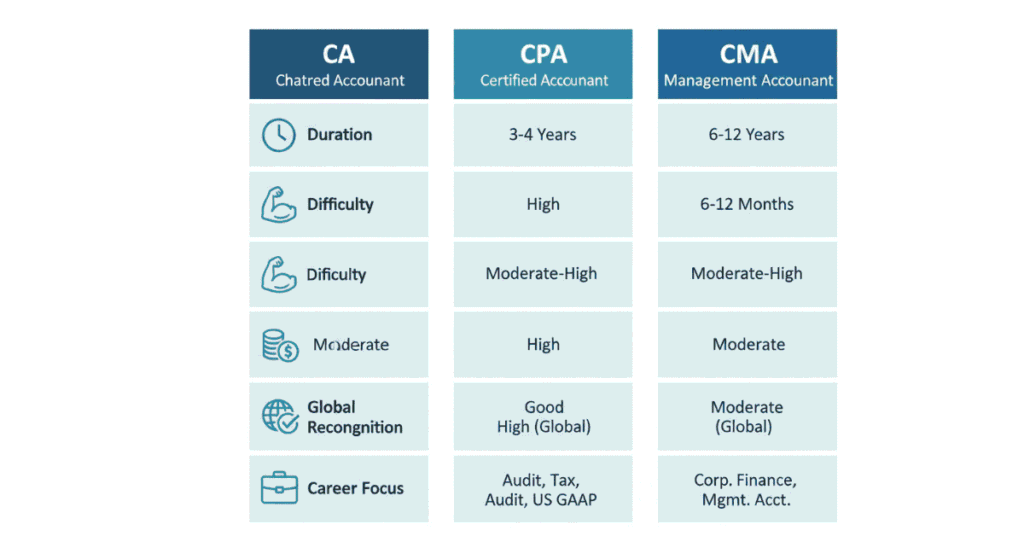

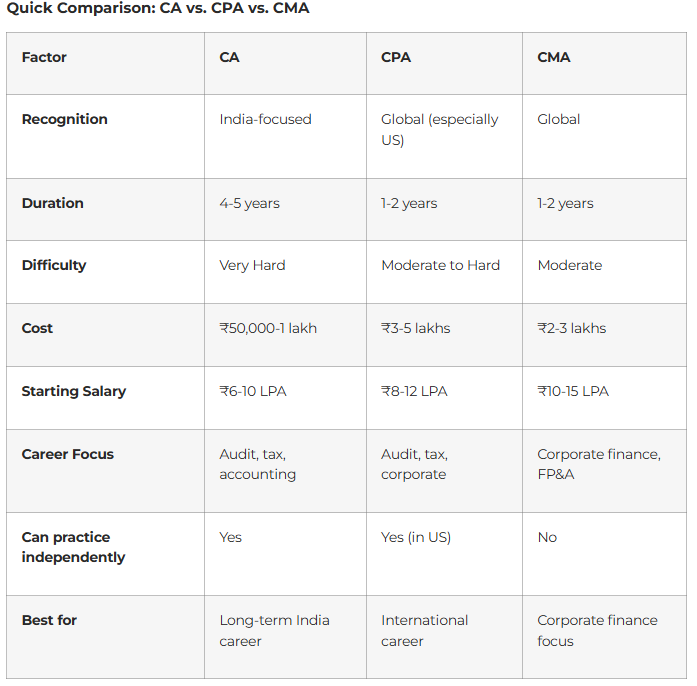

Accounting Certifications: Which One Should You Pursue?

CA (Chartered Accountant) – India’s Premier Accounting Qualification

What it is:

- The highest accounting qualification in India

- Administered by Institute of Chartered Accountants of India (ICAI)

- 4-5 years to complete (Foundation → Intermediate → Final + Articleship)

Career opportunities:

- Corporate accountant, auditor, tax consultant, CFO

- Can practice independently (open your own CA firm)

- Recognized globally (with additional qualifications)

Salary potential:

- Freshly qualified CA: ₹6-10 LPA

- 5 years experience: ₹12-25 LPA

- Senior roles: ₹30-60+ LPA

- CA firm partners: ₹50-200+ LPA

Pros:

- Most recognized in India

- Can practice independently

- Broad career options

- High earning potential

Cons:

- Very difficult exams (pass rate: 5-15%)

- Takes 4-5 years minimum

- Demanding articleship period

CPA (Certified Public Accountant) – Global Recognition

What it is:

- US-based accounting certification

- Recognized globally, especially in US and multinational companies

- 1-2 years to complete (4 exams + experience requirement)

Career opportunities:

- Work in US or with US companies in India

- International accounting firms

- MNCs with US operations

- Higher salary than non-certified accountants

Salary potential in India:

- CPA holder (entry): ₹8-12 LPA

- 5 years experience: ₹20-35 LPA

- Senior roles: ₹40-80 LPA

Pros:

- Shorter duration than CA

- Global recognition

- Higher salary premium in MNCs

- Easier to migrate to US/Canada

Cons:

- Expensive (₹3-5 lakhs total cost)

- Less recognized in small Indian companies

- Need bachelor’s degree with accounting credits

CMA (Certified Management Accountant)

What it is:

- Focuses on management accounting, strategy, and decision-making

- Administered by Institute of Management Accountants (IMA)

- 1-2 years to complete

Career opportunities:

- Corporate finance roles

- FP&A (Financial Planning & Analysis)

- Cost accounting

- Management consulting

Salary potential:

- CMA holder: ₹10-18 LPA

- Senior roles: ₹25-50 LPA

Best for: People interested in corporate finance and strategy rather than traditional accounting or audit.

Auditing: The Financial Detective Career

What is auditing?

Auditing is the process of examining a company’s financial records to ensure they’re accurate, complete, and follow regulations. Think of auditors as financial detectives who verify that companies are telling the truth about their finances.shiksha

Two main types:

- External Audit (Independent Verification)

What they do:

- Review company’s financial statements

- Verify accuracy and compliance

- Provide independent opinion to shareholders and investors

- Detect fraud and errors

Who does it:

- Big 4 firms (Deloitte, PwC, EY, KPMG)

- Mid-tier accounting firms

- Independent CAs

Why it matters: When Infosys publishes annual results, investors trust them because external auditors (like Deloitte) verified the numbers.

Salary:

- Junior Auditor: ₹3-6 LPA

- Senior Auditor: ₹8-15 LPA

- Audit Manager: ₹18-30 LPA

- Audit Partner: ₹50-100+ LPAshiksha

- Internal Audit (Company’s Own Watchdog)

What they do:

- Work inside the company (not independent)

- Verify internal processes are followed

- Identify risks and control weaknesses

- Recommend improvements

- Prevent fraud and errors

Salary:

- Internal Auditor: ₹5-10 LPA

- Senior Internal Auditor: ₹10-18 LPA

- Head of Internal Audit: ₹25-50 LPAshiksha

Best for: People who want stable corporate jobs rather than the demanding life at audit firms.

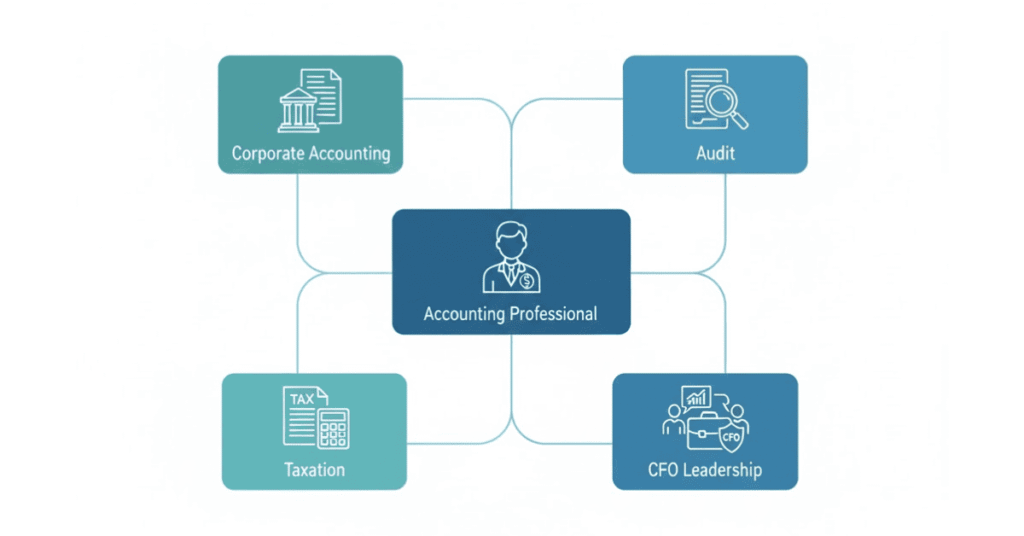

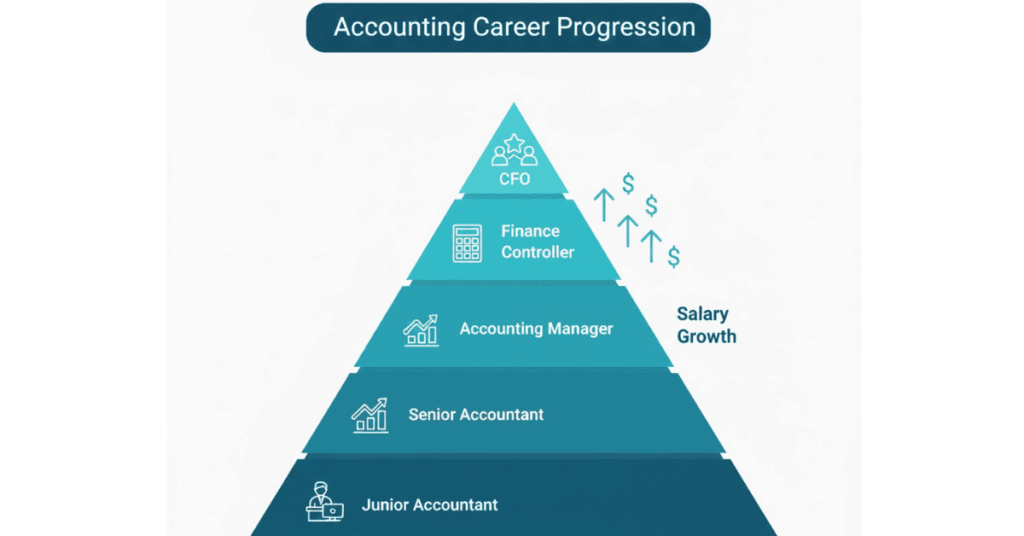

Accounting Career Pyramid: From Junior to CFO

Level 1: Junior Accountant / Accounting Associate (0-2 years)

Responsibilities:

- Record transactions in accounting software

- Reconcile bank statements

- Assist with month-end close

- Prepare basic financial reports

- Learn from senior accountants

Skills needed:

- Basic accounting principles

- Excel (intermediate level)

- Accounting software (Tally, QuickBooks, SAP)

- Attention to detail

- Time management

Salary: ₹2-4 LPAshiksha

Typical day:

text

9:00 AM – Check emails, review tasks for the day

9:30 AM – Record yesterday’s transactions in Tally

11:00 AM – Reconcile bank statements

12:00 PM – Prepare expense report for manager

1:00 PM – Lunch

2:00 PM – Assist senior accountant with month-end close

4:00 PM – File documents and update records

5:00 PM – Review tomorrow’s priorities

5:30 PM – Leave office

Level 2: Senior Accountant (2-5 years)

Responsibilities:

- Supervise junior accountants

- Prepare financial statements

- Handle complex accounting entries

- Coordinate with external auditors

- Month-end and year-end close processes

Skills needed:

- Advanced accounting knowledge

- Advanced Excel (pivot tables, VLOOKUP, macros)

- ERP systems (SAP, Oracle)

- Problem-solving

- Basic management skills

Salary: ₹4-7 LPAshiksha

Level 3: Accounting Manager (5-8 years)

Responsibilities:

- Manage accounting team (3-8 people)

- Ensure accurate and timely financial reporting

- Coordinate audits

- Implement accounting policies

- Work with FP&A and treasury teams

Skills needed:

- Team management

- Strategic thinking

- Deep technical accounting knowledge

- Communication with senior management

- Process improvement mindset

Salary: ₹7-12 LPAshiksha

Level 4: Finance Controller (8-12 years)

Responsibilities:

- Oversee all accounting functions

- Ensure compliance with regulations

- Manage external auditors and tax advisors

- Financial reporting to board and investors

- Strategic financial planning

Skills needed:

- Leadership

- Regulatory compliance knowledge

- Strategic thinking

- Stakeholder management

- Financial analysis

Salary: ₹15-30 LPAshiksha

Level 5: CFO (Chief Financial Officer) (12-20 years)

Responsibilities:

- Lead entire finance function

- Company-wide financial strategy

- Investor relations

- M&A and fundraising

- Board member and executive team

- Drive business growth through financial insights

Skills needed:

- Executive leadership

- Strategic vision

- Business acumen

- Communication and influence

- Financial expertise across all areas

Salary: ₹50-200+ LPA (depending on company size)amityonline

Day in the Life: Auditor at Big 4

Normal Day (Non-Busy Season)

text

9:00 AM – Arrive at client site (bank, manufacturing company, etc.)

9:30 AM – Team huddle: Discuss audit plan for the day

10:00 AM – Test controls: Verify company follows proper processes

12:00 PM – Interview client’s accounting manager

1:00 PM – Lunch with team

2:00 PM – Sample testing: Verify 50 transactions for accuracy

4:00 PM – Document findings in audit working papers

5:30 PM – Team review: Discuss issues found

6:30 PM – Go home (or back to office)

Busy Season (January-March for most companies)

text

8:30 AM – Arrive at client site

9:00 AM – Morning briefing

9:30 AM – Review financial statements line-by-line

12:00 PM – Quick lunch at desk

1:00 PM – Test account balances and reconciliations

4:00 PM – Issues meeting with client finance team

6:00 PM – Document work and prepare for tomorrow

8:00 PM – Team dinner (working)

9:00 PM – Continue documentation

11:00 PM – Finally done, go home

Reality check: Busy season is demanding (60-80 hour weeks), but the rest of the year is more balanced (45-55 hours).

5 Reasons to Start Your Finance Career in Accounting

- Universal Foundation

- Accounting skills apply everywhere

- Easy to pivot to corporate finance, FP&A, banking, or consulting

- You understand business fundamentals better than anyoneshiksha

- Stable Career Path

- Every company needs accountants

- Recession-resistant (accounting is essential even in downturns)

- Clear progression from junior to CFOshiksha

- Global Mobility

- CA + CPA = work anywhere globally

- Accounting standards are similar worldwide

- Easy visa and immigration (accounting is in-demand globally)northstaracad

- Entrepreneurship Option

- Start your own CA/accounting firm

- Be your own boss

- Multiple income streams (audit clients, tax clients, consulting)amityonline

- Strong Earning Potential

- CA partners earn ₹50-200+ LPA

- CFOs earn ₹100-400+ LPA in large companies

- Progressive salary growth with experience