Investment Banking & Portfolio Management Careers

Table of Contents

What Is Investment Banking? (Not What Your Parents Think)

Let’s clear the confusion first. Investment banking is NOT the same as commercial banking (which we covered in Part 1).

Commercial Banking:

- Customers: Regular people and small businesses

- Products: Savings accounts, loans, debit cards

- Work style: 9-to-5, balanced

- Salary: ₹6-15 LPA

Investment Banking:

- Customers: Large corporations, governments, wealthy investors

- Products: Merger advice, IPOs, fundraising, restructuring

- Work style: Fast-paced, high-pressure, long hours

- Salary: ₹8-12 LPA starting → ₹50+ LPA senior roles

Simple analogy: If a regular bank helps you buy a home with a mortgage, investment banking helps a company buy another company worth ₹1,000 crore.

Three Investment Banking Specializations

- M&A (Mergers & Acquisitions)

What they do:

- Help companies merge (combine operations)

- Advise on acquiring other companies

- Value companies and negotiate deals

- Structure complex transactions

Real example:

When Reliance acquired Jio, investment bankers from companies like Goldman Sachs, JP Morgan, and Morgan Stanley advised on the deal structure, valuation, and negotiations. That deal was worth over ₹1.5 lakh crore.

Roles:

- Analyst (0-2 years): Research, data analysis, financial modeling

- Associate (2-5 years): Client presentations, deal execution

- VP (5-10 years): Finding new deals, leading teams

- MD (10+ years): Relationship management, strategy

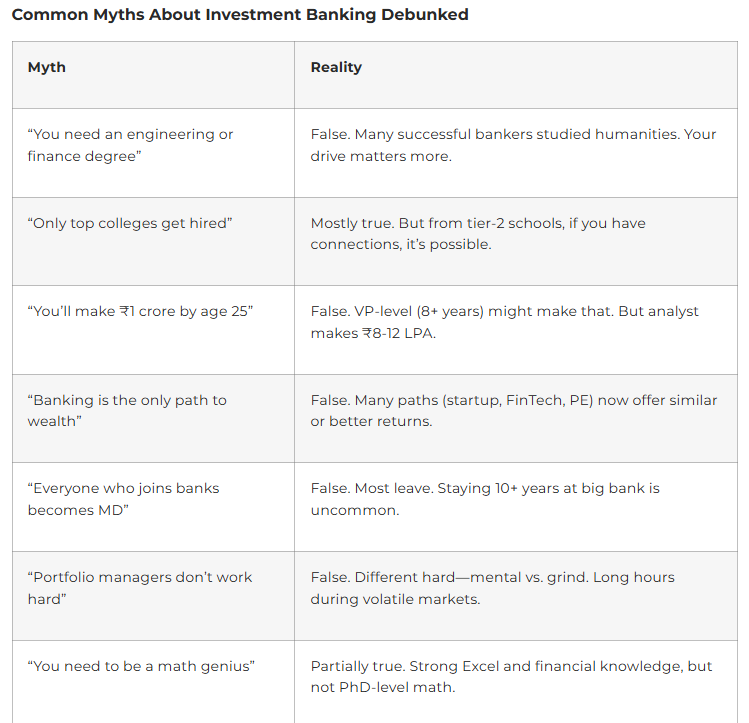

Salary: ₹8-12 LPA (analyst) → ₹50+ LPA (MD)

- DCM (Debt Capital Markets)

What they do:

- Help companies raise money through bonds and loans

- Advise on interest rates and loan structure

- Connect companies with lenders

- Manage ongoing debt relationships

Real example:

When Tata Steel needed ₹10,000 crore to fund expansion, a DCM team helped them issue bonds and arrange loans. They negotiated better interest rates, saving the company ₹100+ crore annually.

Roles:

- Analyst: Document preparation, market research

- Associate: Client interaction, deal structuring

- VP/Director: Relationship building, closing deals

Salary: ₹8-14 LPA (analyst) → ₹40+ LPA (senior)

- ECM (Equity Capital Markets) & IPO Advisory

What they do:

- Help companies go public (IPO – Initial Public Offering)

- Advise on stock pricing

- Connect companies with investors

- Manage roadshows and investor relations

Real example:

When Paytm went public in 2021, investment bankers managed the entire IPO process—from company valuation to investor pitches to stock listing. The IPO raised ₹18,300 crore.

Roles:

- Analyst: Market research, pitch deck creation

- Associate: Investor meetings, document management

- VP: Leading investor roadshows, pricing strategy

Salary: ₹8-12 LPA (analyst) → ₹45+ LPA (VP)

Real Talk: Investment Banking Lifestyle

The Honest Truth About Hours:

An investment banking analyst works roughly:

- Regular days: 60-70 hours per week

- Deal closing days: 80-100+ hours per week (yes, all-nighters happen)

- Weekends: Usually working at least 1 day

- Vacations: Often interrupted by urgent deals

Why so demanding?

- Deals don’t operate on 9-to-5 schedules

- Client expectations: Get it done NOW

- Competitive culture: Outworking peers gets you ahead

- Financial modeling: Complex, time-consuming work

The Flip Side (Why People Still Do It):

- Prestige: “I work for Goldman Sachs” opens doors globally

- Salary: ₹8 LPA → ₹50+ LPA in 10 years is extraordinary

- Learning: You learn in 2 years what takes 5 years elsewhere

- Network: Meet CEOs, entrepreneurs, influential people

- Exit opportunities: After 3-5 years, everyone wants you. Jump to FinTech, PE, startups, or corporate at senior levels

Portfolio & Wealth Management: A Different Beast

Portfolio Management Career Paths

- Equity Research Analyst

What they do:

- Research companies and stock markets

- Create investment recommendations

- Write detailed reports on industries and stocks

- Advise portfolio managers on buy/sell decisions

Typical day:

- 9:00 AM: Read overnight market reports

- 10:00 AM: Call with company management team

- 12:00 PM: Analyze financial statements

- 2:00 PM: Update investment model

- 4:00 PM: Write report and recommendations

- 5:00 PM: Present findings to portfolio manager

Salary:

- Entry-level: ₹8-12 LPA

- Mid-level: ₹15-25 LPA

- Senior analyst: ₹25-40+ LPA

Why it’s interesting:

- You’re essentially a detective finding investment opportunities

- Constant learning about different industries

- Your research directly impacts investment decisions

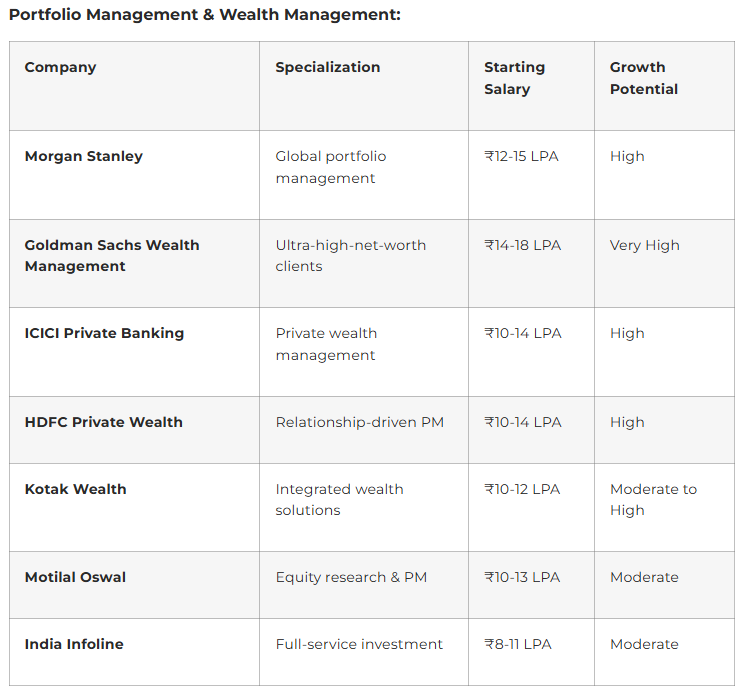

Top employers: Morgan Stanley, Goldman Sachs, ICICI Securities, Motilal Oswal, India Infolinemorganstanley

- Portfolio Manager

What they do:

- Manage client investment portfolios (₹50 crore to ₹1,000+ crore)

- Make buy/sell/hold decisions

- Meet with clients and explain strategy

- Aim to beat market benchmarks (Sensex, Nifty)

Real responsibility:

If you manage ₹100 crore in portfolios and your decisions lose 10% in a year, you’ve just lost ₹10 crore of client wealth. That’s the weight of this role.

Salary:

- Starting as junior PM: ₹12-18 LPA

- Established PM: ₹30-50+ LPA

- Top-performing PMs: ₹50-100+ LPA + performance bonus

Why it’s attractive:

- Highest earning potential among all finance roles (if you perform well)

- Direct impact on investment returns

- Client relationships are long-term and rewarding

- Wealth Manager (Private Banking)

What they do:

- Manage wealth for high-net-worth individuals (₹5+ crore)

- Provide holistic financial planning (investments, taxes, estate planning, insurance)

- Understand client goals and fears

- Make personalized recommendations

Unique aspect: You’re not just a numbers person—you’re a financial life advisor. You help a successful entrepreneur plan for retirement, tax efficiently, minimize risks, and pass wealth to children.

Salary:

- Entry-level WM: ₹8-15 LPA

- Senior WM: ₹20-35+ LPA

- Top WMs (managing ₹100+ crore): ₹50+ LPA

Top companies:

- ICICI Private Banking

- HDFC Private Wealth

- Kotak Wealth

- Axis Private Wealth

- DSP Asset Managementimperialbschool

Why careers thrive here:

- Recurring relationships = stable career

- Relationship-driven, not deal-driven

- Better work-life balance than investment banking

- Average tenure: 10+ years with same clients

Critical Soft Skills:

- Communication: Present complex analysis to non-technical people

- Pressure management: Deal with high-stress situations

- Attention to detail: One error in financial modeling can cost millions

- Teamwork: IB is collaborative; your model quality depends on team research

- Client management: Understand what clients really want (not what they say)

- Business acumen: Think like a CEO, understand business strategy

How to Break Into Investment Banking

Step 1: Educational Foundation (During College)

- Take finance courses: Corporate finance, investments, financial analysis

- Join clubs: Investment club, business club

- Get internships: Banking intern role (even 1 month helps)

- Learn Excel: Become expert-level

- Take CFA Level 1: Shows commitment

- Network: Meet IB analysts, attend finance events

Step 2: Crack the Internship (Crucial!)

Where to apply:

- Banks: Goldman Sachs, JPMorgan, Morgan Stanley, Citi

- Indian firms: Investment bankers, boutique IB firms

- Corporate Finance teams (less glamorous but good experience)

Interview process:

- Resume screening: GPA, internships, extracurriculars matter

- Phone screen: Tell your story, why finance?

- Case interviews: Business problems + math

- Superday: Full-day interviews with multiple rounds

Sample case question:

“An oil company wants to acquire a renewable energy company. What due diligence would you recommend?”

Your answer should cover:

- Financial analysis (revenue, profit trends)

- Market analysis (growth in renewable energy)

- Integration risks

- Valuation approach

- Deal structure considerations

Pro tip: Practice with case interview websites (CaseCoach, Victor Cheng’s framework)

Step 3: Convert Internship to Full-Time

- Excel during internship: Be the hardest worker

- Build relationships: Have meaningful conversations with senior bankers

- Show initiative: Suggest improvements, go beyond assigned work

- Network after: Meet your analyst/associate mentors for coffee

- Follow up: When full-time recruiting opens, you have internal champions

Step 4: Land Your Analyst Role

Top recruiters:

- Global banks: Goldman Sachs, JPMorgan, Morgan Stanley, Bank of America Merrill Lynch (BAML)

- Indian banks: ICICI Securities, Goldman Sachs (Mumbai office), JP Morgan (Mumbai office)goldmansachs+1

Salary expectations:

- Base: ₹8-12 LPA

- Signing bonus: ₹2-3 LPA

- Performance bonus: ₹2-5 LPA (varies with market)

- Total: ₹12-20 LPA in good years

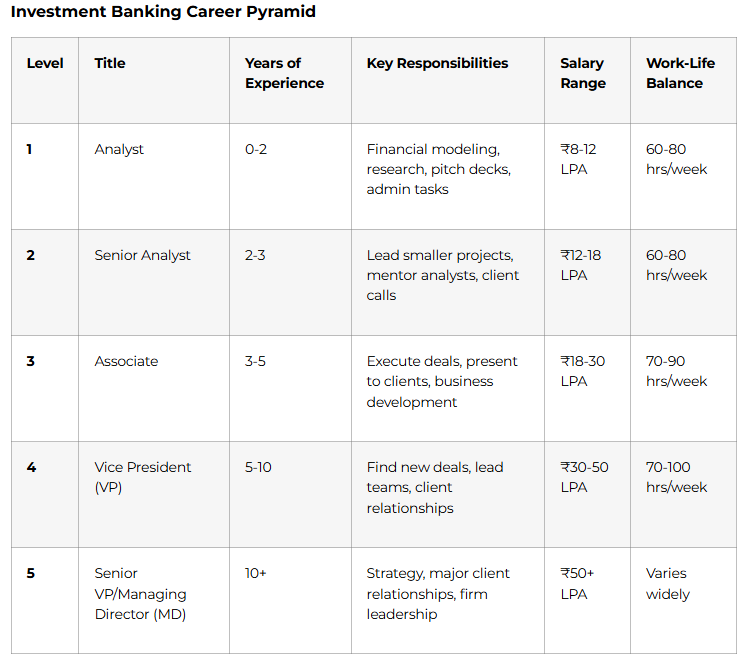

Analyst to Partner: Your 10-Year Investment Banking Journey

Years 1-2: Analyst (The Grind)

- Hours: 60-80/week

- Work: Financial modeling, pitch decks, research

- Learning: Understanding deals, financial analysis fundamentals

- Salary: ₹8-12 LPA

- Mindset: Survive and learn as much as possible

Years 2-3: Senior Analyst

- Hours: 60-80/week

- Responsibilities: Lead smaller projects, mentor analysts

- Salary: ₹12-18 LPA

- Milestone: First deal closure, first client meeting

- Consideration: MBA or exit now? Most people decide here

Years 3-5: Associate

- Hours: 70-90/week

- Responsibilities: Execute deals, find new business, relationship building

- Salary: ₹18-30 LPA (often includes MBA)

- Challenge: Transitioning from execution to business development

- Decision: Stay for VP? Or move to corporate, PE, or FinTech?

Years 5-10: Vice President

- Hours: 70-100/week

- Responsibilities: Bring in deals, lead teams, major client relationships

- Salary: ₹30-50 LPA

- Lifestyle: Still demanding but more autonomy

- Milestone: Recognized expert in your sector (tech, healthcare, etc.)

Year 10+: Senior VP/MD (Managing Director)

- Hours: Varies (often 60-70 when not on deals)

- Responsibilities: Firm leadership, major client management, strategy

- Salary: ₹50+ LPA

- Reward: Impact on firm strategy, mentoring future leaders

- Options: Stay at bank or move to PE, hedge fund, corporate leadership

Exit Opportunities: Where Bankers Go Next

After 2 years (Most Analysts Exit Here):

- Private Equity (PE): Leverage banking skills, better lifestyle, ₹20-30 LPA → ₹100+ LPA (with performance bonus)

- Corporate Finance (FP&A): Work for company instead of advising, ₹15-20 LPA

- FinTech: Join Paytm, Razorpay, Goldman Sachs digital platforms, ₹15-25 LPA + equity

After 5 years (Associates Often Exit):

- Head of Corporate Finance: ₹30-50 LPA

- Partner in PE fund: ₹30-100+ LPA

- Startup Founder: Leverage network and skills

- Hedge Fund Analyst: ₹20-40 LPA + performance bonus

Long-term (VPs and MDs):

- Venture Capital: Invest in startups, advisory board roles

- CFO/Finance Director: Lead finance function of major companies

- Boutique Investment Bank: Start your own IB firm

Day in the Life: Investment Banking Analyst

Monday – Regular Deal Week

text

7:30 AM – Wake up, check emails (often 50+ unread)

8:30 AM – Quick breakfast at desk

9:00 AM – Team sync: Discuss Acquisition pitch we’re working on

10:00 AM – Build financial model for target company

1:00 PM – Lunch at desk (or skip)

2:00 PM – Revise model based on MD feedback

4:00 PM – Create slides for client presentation

6:00 PM – Partner meeting: Presentation feedback

7:00 PM – Update model again, finalize slides

9:00 PM – Send updated deck to client

9:30 PM – Go home (early night!)

Friday – Deal Closing Week

text

9:00 AM – Already here (since last night at 2 AM)

9:15 AM – Client call: Last-minute questions

10:00 AM – Update financial model with new terms

12:00 PM – Lunch meeting with opposing bank

1:30 PM – Back to redline docs with legal

3:00 PM – Call with tax advisors

5:00 PM – Model revision with new assumptions

7:00 PM – Dinner with team (discussing deal)

9:00 PM – Update models for morning presentation

12:00 AM – Still working

2:00 AM – Finally done, go home

8:00 AM – Back at desk (deal closing later today)

Reality check: This lifestyle is intense. Most people last 2-4 years before burning out.

Portfolio Manager’s Typical Day (Comparison)

text

8:30 AM – Market open (NSE, BSE)

9:00 AM – Review portfolio performance, overnight changes

9:30 AM – Morning meeting: Market outlook and strategy

10:00 AM – Equity research analyst meeting: Stock recommendations

11:00 AM – Make buy/sell decisions, place trades

12:00 PM – Client call: Explain recent market movements

1:00 PM – Lunch

1:30 PM – Read company reports, research opportunities

3:00 PM – Team meeting: Portfolio positioning

4:00 PM – Market close (NSE closes at 3:30 PM)

4:30 PM – Review day’s performance, adjust positions

5:30 PM – Plan for next day

6:00 PM – Leave office (or stay for analysis)

Notice the difference: Similar hours sometimes, but PM life is more strategic and less about all-nighters.

Top Companies Hiring in Investment Banking & Portfolio Management

Quick Decision Framework: Investment Banking vs. Portfolio Management

Choose Investment Banking IF:

- You thrive under extreme pressure

- You want rapid career progression

- You prefer project-based work

- You’re ambitious and want to build networks fast

- You can tolerate 70+ hour weeks

- You want maximum earning potential early

Choose Portfolio Management IF:

- You want sustainable long-term career

- You enjoy strategic thinking

- You prefer client relationships over projects

- You value work-life balance (relatively)

- You love markets and investments

- You want expertise over hustle