Banking Careers Explained Your Complete Path to Banking Jobs

Table of Contents

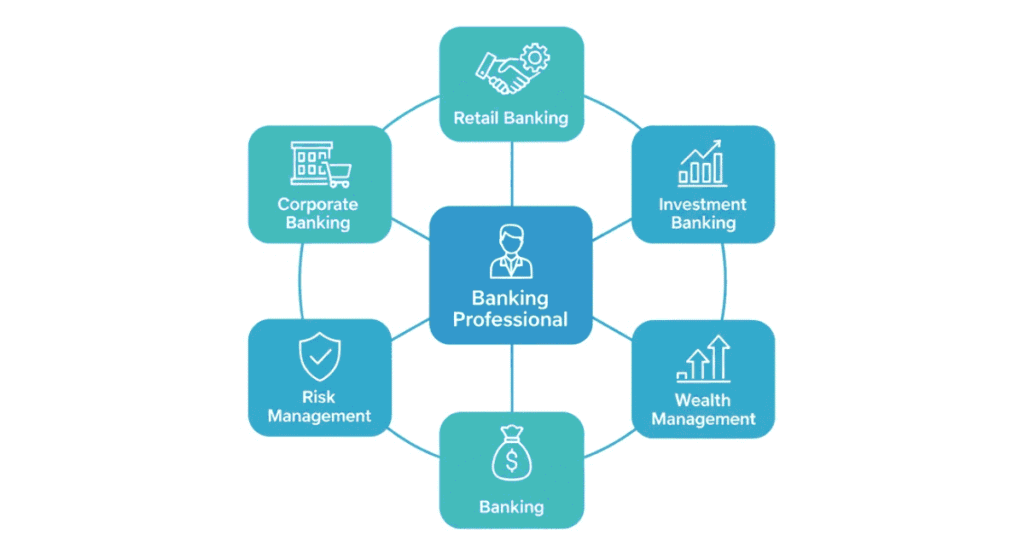

What Exactly Do Banks Do? (And Why Should You Care?)

Banks are financial institutions that:

- Hold money: Manage savings and checking accounts

- Lend money: Provide loans to individuals and businesses

- Manage investments: Help customers grow their wealth

- Process payments: Move money between accounts and countries

- Mitigate risk: Protect customers from financial losses

If banks are the arteries of an economy, banking professionals are the ones keeping the blood flowing. Your role? Keep this system running smoothly.

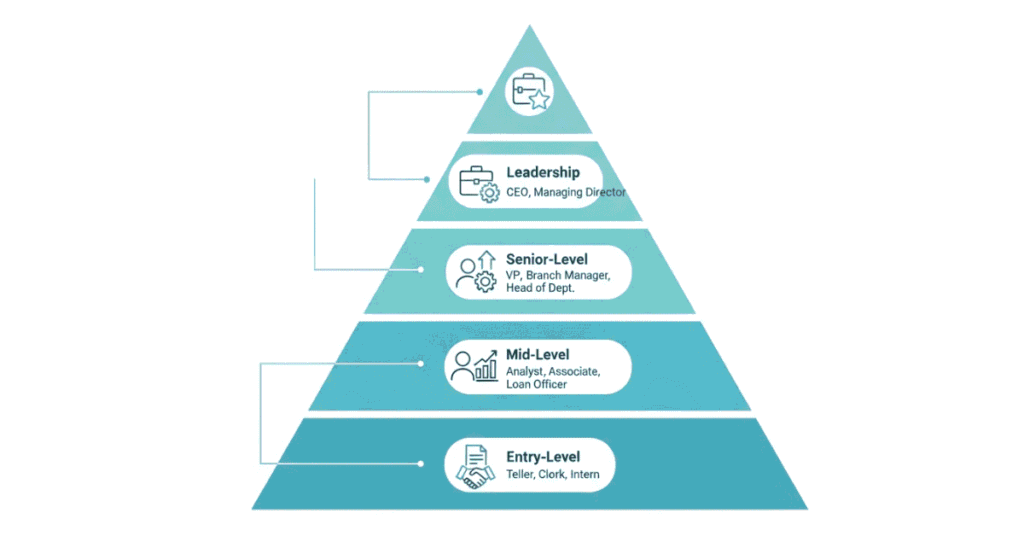

Banking Career Pyramid: From Entry-Level to Leadership

Banking has a clear hierarchy. Here’s how you climb:

Level 1: Entry-Level (0-2 Years)

Junior Financial Analyst

- What you do: Analyze financial data, create reports, support senior analysts

- Required skills: Excel, financial analysis basics, attention to detail

- Salary: ₹6-8 LPA

- Companies hiring: ICICI, HDFC, Federal Bank, SBI

- Typical day: Creating spreadsheets, attending meetings, learning from mentors

Business Associate / Operations Executive

- What you do: Handle customer queries, process transactions, basic compliance work

- Salary: ₹4-6 LPA

- Companies: Most banks hire these roles extensively

- Growth: Often a stepping stone to better roles

Relationship Executive (Entry-Level)

- What you do: Acquire new customers, maintain relationships, cross-sell products

- Salary: ₹5-8 LPA (base) + commissions

- Perfect for: Outgoing, sales-oriented people

Level 2: Mid-Level (2-5 Years)

Senior Financial Analyst

- What you do: Lead financial analysis projects, mentor juniors, deeper insights

- Salary: ₹10-15 LPA

- Required skills: Advanced Excel, SQL, financial modeling, communication skills

Relationship Manager

- What you do: Manage portfolio of customers, advise on investments, achieve targets

- Salary: ₹8-18 LPA (base + commission)

- Best suited for: People who love client interaction

Credit Analyst

- What you do: Evaluate loan applications, assess creditworthiness, manage loan portfolio

- Salary: ₹10-15 LPA

- Skills needed: Credit risk assessment, financial analysis, judgment

Risk Analyst

- What you do: Identify, analyze, and mitigate financial and operational risks

- Salary: ₹12-18 LPA

- Why it matters: Banks lost billions during financial crises because risk managers weren’t strong enough. This job prevents that.

Level 3: Senior-Level (5-10 Years)

Senior Relationship Manager / Relationship Manager (Wealth)

- What you do: Manage high-net-worth clients, design customized investment strategies

- Salary: ₹18-30+ LPA

- Companies: Private banks (ICICI Private, HDFC Private), premier banking divisions

Senior Risk Manager / Risk Manager

- Salary: ₹20-35 LPA

- What you do: Lead risk management strategy, oversee compliance

Branch Manager

- What you do: Manage entire branch operations, staff, profitability

- Salary: ₹18-25 LPA

- Unique advantage: Clear path to leadership

Level 4: Leadership (10+ Years)

Senior Manager / Assistant Vice President (AVP)

- Salary: ₹25-40+ LPA

- What you do: Department head, strategic planning, mentoring teams

Vice President (VP)

- Salary: ₹35-60+ LPA

- What you do: Oversee multiple departments, make major strategic decisions

Chief Financial Officer (CFO)

- Salary: ₹50+ LPA

- What you do: Manage entire finance function of the organization

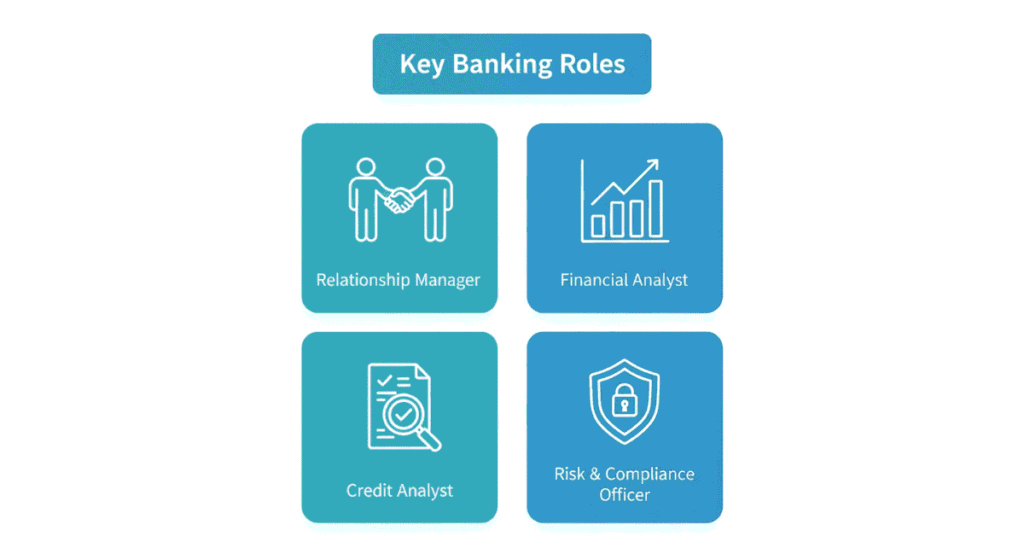

Most In-Demand Banking Roles

- Relationship Manager (The Swiss Army Knife of Banking)

What they do:

Think of yourself as a financial advisor and sales professional combined. You:

- Manage a portfolio of 200-500 customers

- Understand their financial goals

- Recommend banking products (loans, investments, insurance)

- Maintain relationships and ensure customer satisfaction

Why companies love this role: Relationship managers directly generate revenue. The better you manage clients, the more money the bank makes.

Salary: ₹8-18 LPA depending on performance and customer portfolio

Skills needed:

- Communication (explaining finance in simple terms)

- Sales skills (not pushiness—consultative selling)

- Product knowledge (loans, investments, insurance)

- Problem-solving abilities

Career progression: Entry-level RM → Senior RM → Regional Manager → Director of Sales

- Financial Analyst (The Data Detective)

What they do:

- Analyze financial statements, trends, and market data

- Create financial models and forecasts

- Support decision-making with data-backed insights

- Prepare reports for management and clients

Why it matters: Every decision in a bank is data-driven. Financial analysts are the people providing that data.

Salary: ₹6-10 LPA (entry) → ₹15-25 LPA (senior)

Skills needed:

- Excel (absolute must): Advanced functions, pivot tables, dashboards

- SQL or Python: For data extraction and analysis

- Financial modeling: Building valuation models

- Communication: Explaining complex data simply

Career progression: Junior Analyst → Financial Analyst → Senior Analyst → Finance Manager

Why start here? This is one of the best entry points into finance. Learn the fundamentals, and you can move to investment banking, FinTech, or corporate finance later.

- Credit Analyst (The Risk Assessor)

What they do:

- Review loan applications

- Assess borrower creditworthiness

- Recommend approval or rejection

- Monitor existing loans for early warning signs

Why it’s crucial: One bad loan decision can cost the bank millions. Credit analysts protect bank capital.

Salary: ₹10-15 LPA (entry to mid-level) → ₹20-35 LPA (senior)

Skills needed:

- Financial statement analysis

- Credit risk assessment

- Judgment and decision-making

- Understanding of credit policies and regulations

Real example: A farmer applies for a ₹50 lakh loan. You analyze his land value, income history, repayment capacity, and family situation. Your decision determines whether his business grows or fails. That’s the weight of this role.

- Risk & Compliance Officer (The Guardian)

What they do:

- Monitor banks for regulatory compliance

- Identify operational and market risks

- Implement risk mitigation strategies

- Ensure the bank follows all laws and regulations

Why it’s important: Non-compliance can cost banks billions in fines. 2023 saw banks globally fined over $10 billion for compliance failures.

Salary: ₹12-25 LPA → ₹30-50+ LPA (senior)

Skills needed:

- Knowledge of banking regulations (Basel III, Know Your Customer rules, etc.)

- Attention to detail

- Analytical thinking

- Understanding of financial crimes

Growing demand: Every bank is investing heavily in risk management post-pandemic.

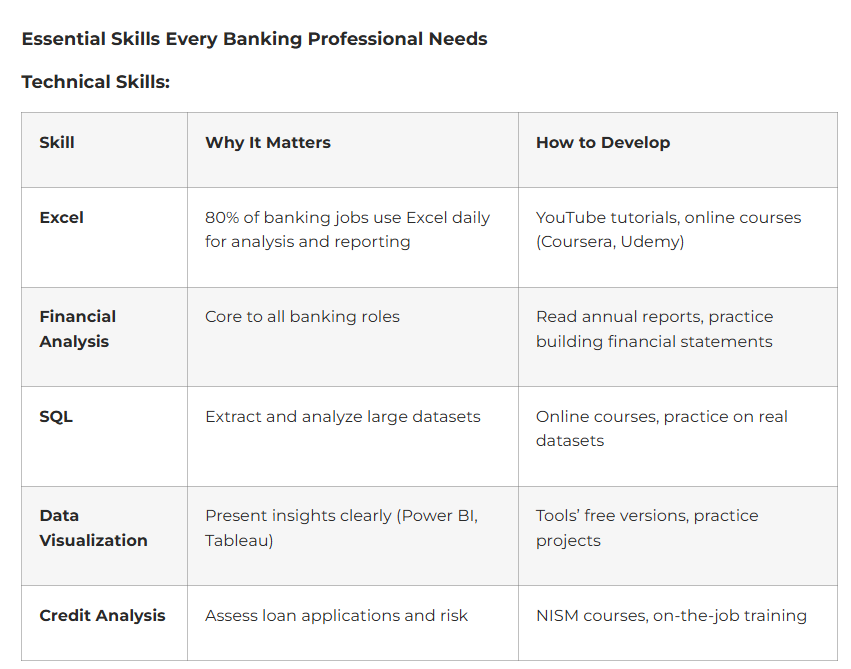

Soft Skills (Often More Important Than You Think):

- Communication: Explain complex finance to non-technical people

- Time management: Handle multiple clients/projects simultaneously

- Problem-solving: Think on your feet, adapt to situations

- Teamwork: Banking is collaborative—you’ll rarely work alone

- Customer service: Banking is service-oriented; treat clients well

- Integrity: Trust is everything in finance; ethical behavior is non-negotiable

Day in the Life: Different Banking Roles

A Relationship Manager’s Day:

text

8:00 AM – Check emails, review client portfolio performance

9:00 AM – Client call: Help customer choose investment option

10:30 AM – Meeting with senior manager: Discuss Q3 targets

12:00 PM – Lunch

1:00 PM – Visit to client’s office: Discuss business expansion loan

3:00 PM – Back at bank: Prepare loan proposal

4:00 PM – Call prospective client: Business development

5:30 PM – Wrap up: Update CRM system, send reports

A Financial Analyst’s Day:

text

8:30 AM – Review overnight market data, check for anomalies

9:30 AM – Build monthly financial model for management

11:00 AM – Meeting: Present insights to senior team

12:30 PM – Lunch

1:30 PM – Analyze competitor financial statements

3:00 PM – Dashboard updates, prepare client reports

4:30 PM – Attend training: Advanced Excel skills

5:30 PM – Final reviews and data checks before close

How to Land Your First Banking Job

Step 1: Build Your Foundation

- Get a bachelor’s degree (any stream, but commerce/finance is preferred)

- Learn Excel inside-out (can’t stress this enough)

- Take basic finance courses: Read books like “The Intelligent Investor” or watch YouTube channels explaining finance

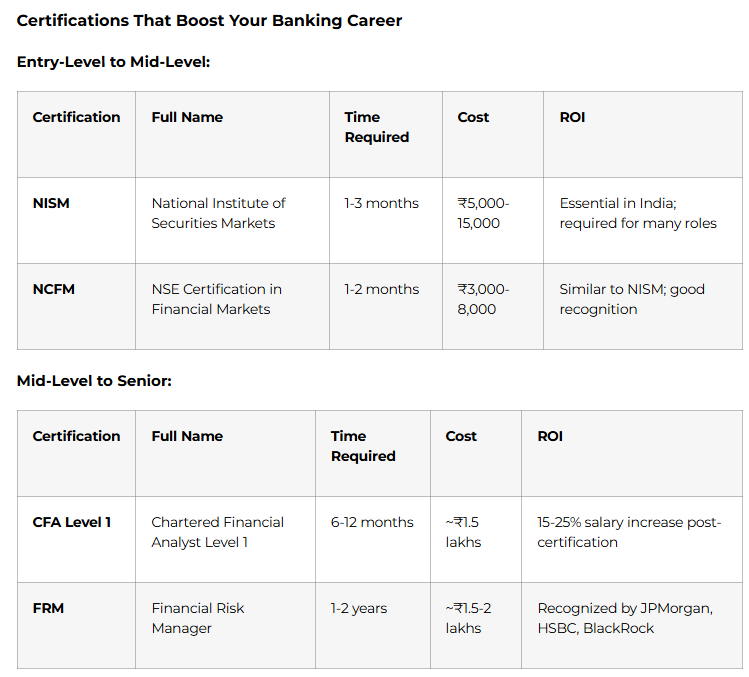

- Get NISM or NCFM certification: Shows you’re serious about finance

Step 2: Create Your Application Strategy

- Target banks by tier:

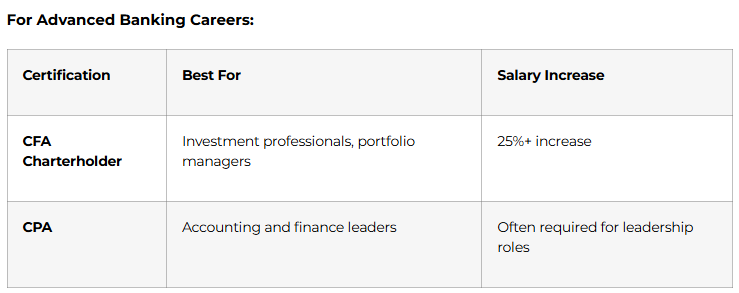

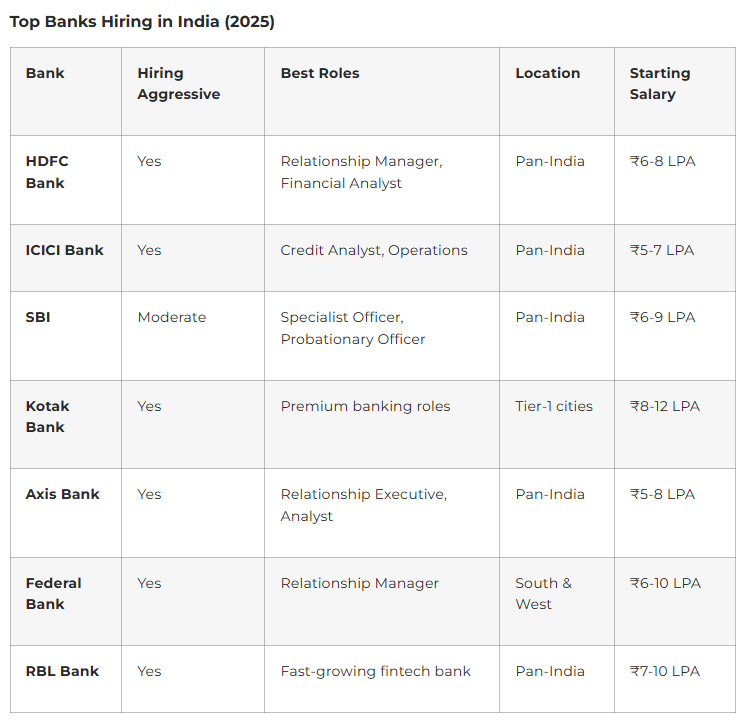

- Tier 1: HDFC, ICICI, SBI, Kotak, Axis

- Tier 2: Federal Bank, RBL, IndusInd

- Tier 3: Regional banks and newly launched startups

- Look for: Relationship Executives, Financial Analysts, Operations roles

- Apply on: Bank websites, LinkedIn, Indeed, AmbitionBox

Step 3: Nail the Interview

Technical Questions You’ll Face:

- “What do you understand by credit risk?”

- “Can you explain a balance sheet?”

- “How would you evaluate a loan application?”

- “What are the key financial ratios?”

Behavioral Questions:

- “Tell me about a time you handled a difficult customer.”

- “Describe a situation where you failed and what you learned.”

- “Why do you want to work in banking?”

Pro Tips:

- Prepare with real examples from internships or projects

- Understand the bank’s recent news and announcements

- Ask intelligent questions about their operations

- Follow up within 24 hours with a thank-you email

Step 4: Negotiate Your Offer

- First offer is usually not the final offer

- Research average salaries on AmbitionBox and Glassdoor

- Negotiate based on skills and experience

- Consider growth potential, not just salary

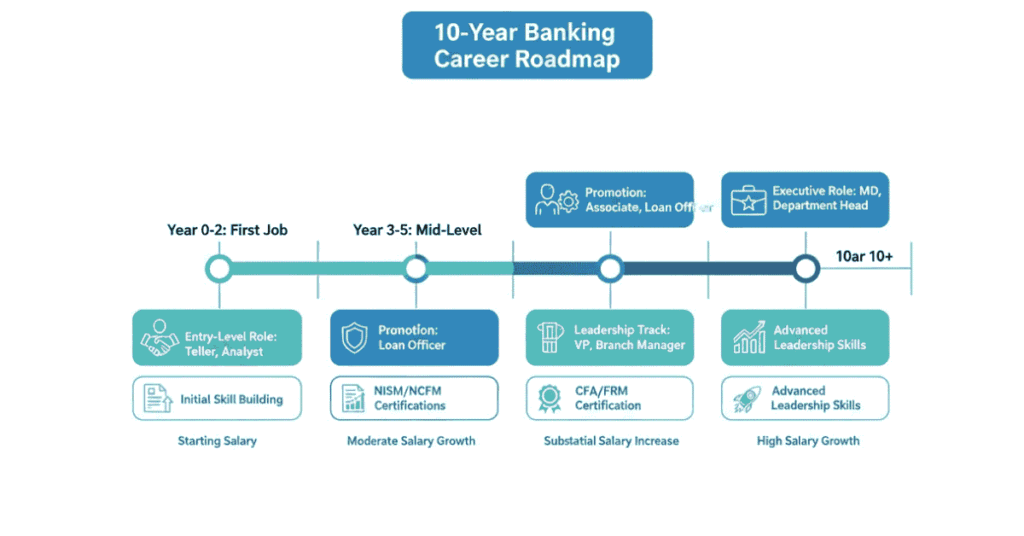

Your Banking Career Roadmap: Next 10 Years

Year 1-2: Foundation Building

- Secure your first banking role

- Master Excel and basic financial analysis

- Get NISM/NCFM certification

- Expected salary: ₹6-8 LPA

Year 3-5: Specialization

- Decide your focus: wealth management, risk, credit, FP&A

- Lead small projects, mentor juniors

- Consider CFA Level 1

- Expected salary: ₹12-18 LPA

Year 6-10: Leadership

- Move to senior/leadership role

- Build your professional network

- Pursue CFA Charterholder or other advanced certifications

- Expected salary: ₹25-40+ LPA

Year 10+: Executive Level

- Director, VP, or function head

- Strategic decision-making

- Expected salary: ₹40-100+ LPA