Finance Industry Career Guide

Table of Contents

Banking, Investment & FinTech Jobs

Introduction

Ever wondered why your finance-loving friend got hired at JPMorgan Chase right after graduation? Or why a colleague jumped from a bank to a FinTech startup and saw their salary double? The finance industry in 2025 isn’t just about counting money anymore—it’s about solving real-world problems, managing digital currencies, predicting market trends, and helping businesses grow.

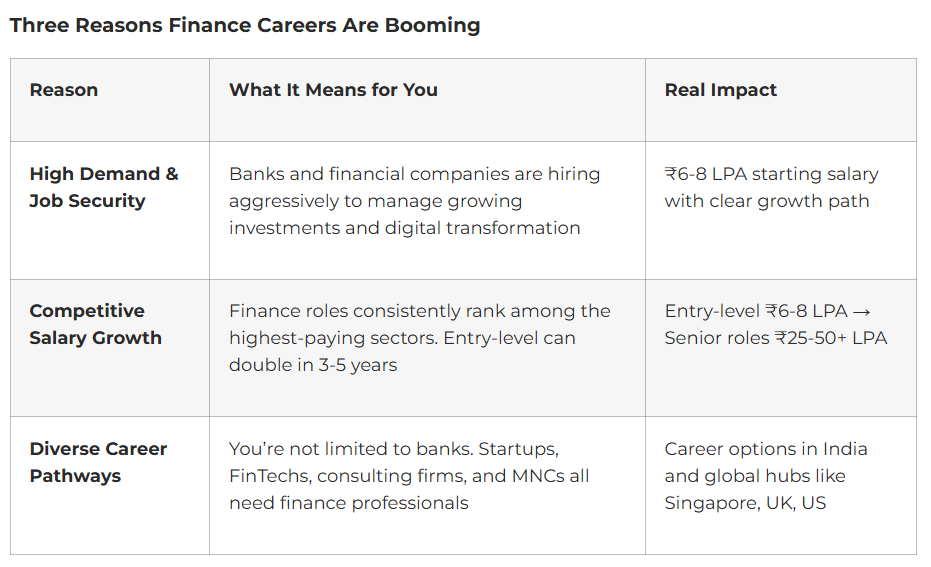

Here’s the truth: finance is one of the highest-paying career paths in 2025, and the demand isn’t slowing down. According to recent data, 72% of employers in the banking and financial services sector are actively expanding their teams. This means more jobs, better salaries, and diverse career options than ever before.

Whether you’re a fresher wondering where to start or someone considering a career pivot, this guide breaks down everything you need to know about finance careers—without the jargon that makes your head spin.

Why Finance? A Career That Makes Sense in 2025

The Reality Check: Who Should Consider Finance?

Finance isn’t for everyone, and that’s okay. This path is perfect if you:

- Enjoy solving problems with data and numbers

- Want a career with strong job security and growth potential

- Are interested in how money, markets, and businesses work

- Can work under pressure and adapt to changing situations

- Want a competitive salary that rewards your expertise

If this sounds like you, let’s explore why finance is such a smart choice right now

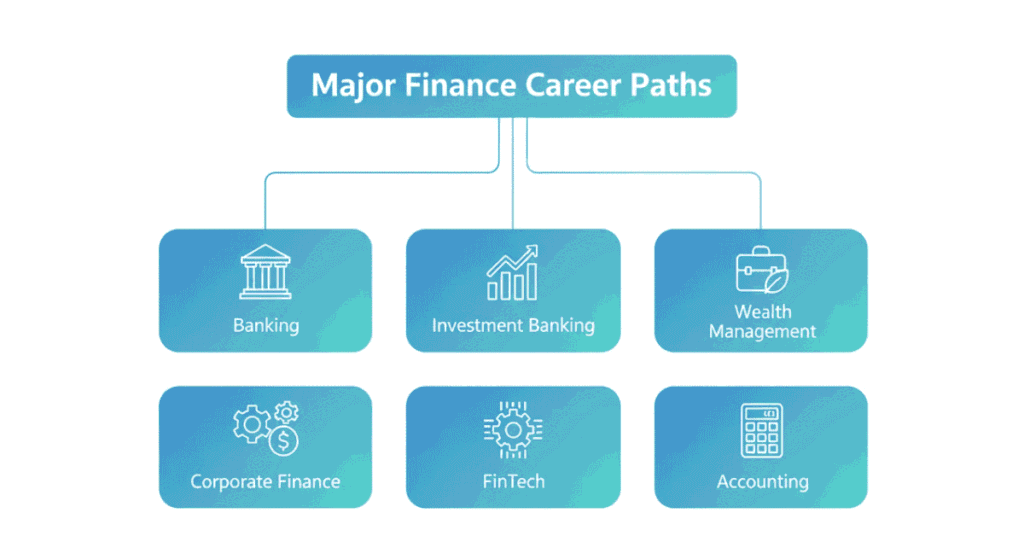

Main Finance Career Paths

Think of finance like a tree with many branches. You don’t have to choose just one—you can explore different paths as your career grows.

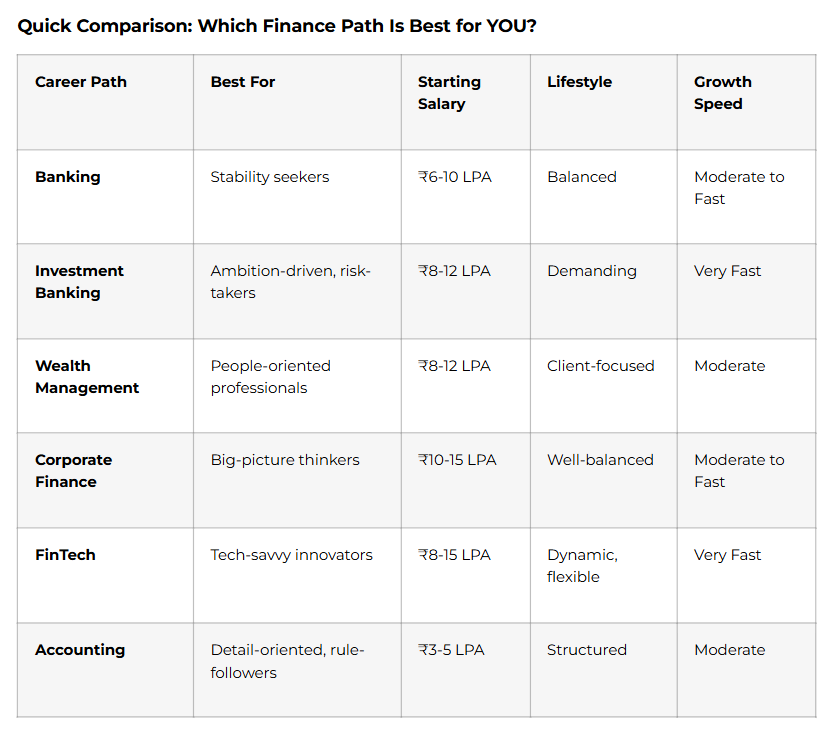

- Banking Careers (The Traditional Foundation)

Banking is the backbone of the finance industry. Banks handle everything from managing customer deposits to facilitating business loans.

Common Banking Roles:

- Financial Analyst: You’ll analyze financial data, create reports, and help banks make smart investment decisions. Starting salary: ₹6-10 LPA. Companies: ICICI, HDFC, SBI, Federal Bank.

- Relationship Manager: Think of yourself as a “money consultant” for high-net-worth clients. You manage their investments and financial plans. Salary: ₹8-18 LPA (senior roles exceed ₹30 LPA).

- Loan Officer: You evaluate loan applications, assess risk, and decide whether customers qualify for loans. Entry-level: ₹4-6 LPA.

- Credit Risk Analyst: Your job is to predict which loans might go bad and protect the bank from losses. Salary: ₹12-25 LPA. Skills needed: Risk models, Python/R, understanding of Basel regulations.

Why Choose Banking:

- Structured career progression

- Stable work environment

- Global opportunities

- Strong employer branding

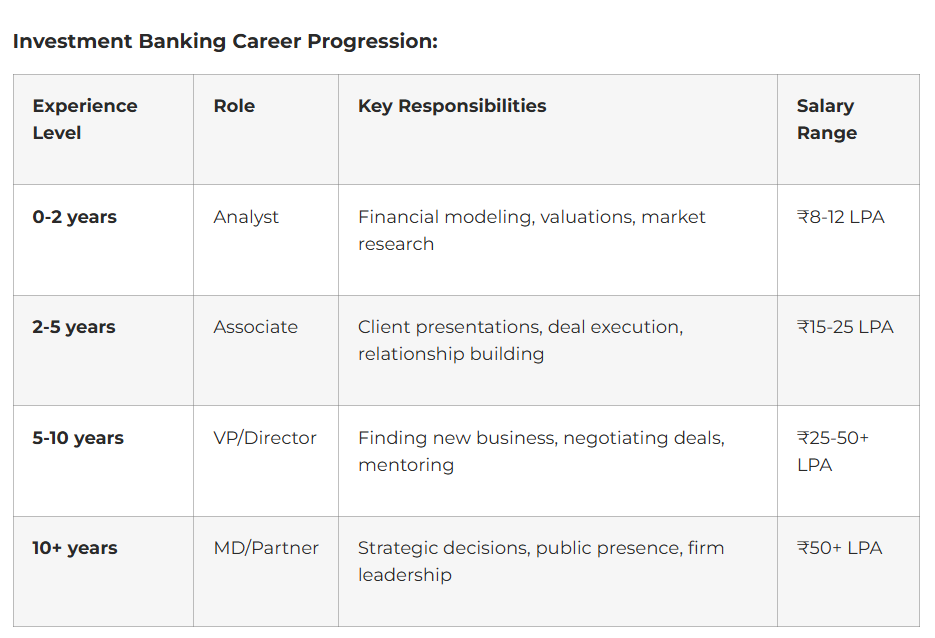

- Investment Banking (The Fast Lane)

Investment banking is high-energy, high-pressure, and high-reward. Investment bankers help companies merge, raise capital, or go public on the stock market.

Real Talk About Investment Banking:

- Pros: Highest salaries early in career, prestige, exposure to major business deals

- Cons: Long working hours (60-80+ hour weeks), high-stress environment, work-life balance challenges

- Top Recruiters: Morgan Stanley, Goldman Sachs, JP Morgan, Citi

Is It Right for You?

Only if you thrive under pressure, love financial modeling, and are willing to sacrifice some personal time early in your career for long-term gain.

- Wealth & Portfolio Management (Helping Rich Clients Get Richer)

Portfolio managers guide individuals and institutional investors in growing and protecting their wealth. It’s part advisor, part strategist.

Key Roles:

- Portfolio Manager: Design investment strategies tailored to client goals

- Wealth Manager: Provide holistic financial planning including investments, taxes, and estate planning

- Equity Analyst: Research stocks and make recommendations

What You’ll Earn: ₹8-18 LPA (mid-level) → ₹30+ LPA (senior). Top companies: Kotak Wealth, HNI desks, private banks.

Perfect For: People who love one-on-one client interaction and want to build long-term relationships.

- Corporate Finance (The Backbone of Big Companies)

Every large company—whether it’s a bank, IT firm, or manufacturing company—has a corporate finance team. Their job? Manage the company’s money, budget, and investments.

Popular Corporate Finance Roles:

- Financial Planning & Analysis (FP&A) Manager: Create budgets, forecast future earnings, and analyze business performance

- Corporate Treasurer: Manage company liquidity, handle forex, and protect against financial risks

- Finance Controller: Oversee all accounting and financial reporting

Salary Outlook: ₹15-35+ LPA depending on company size and experience. Top employers: MNCs like Infosys, TCS, and global corporations.

Why It’s Great:

- Better work-life balance than investment banking

- Exposure to entire business operations

- Career path to CFO (Chief Financial Officer)

- FinTech & Digital Finance (The Future is Here)

FinTech is the fastest-growing segment in finance. Companies like Paytm, PhonePe, and Razorpay are disrupting traditional banking with apps and digital solutions.

Hot FinTech Roles

- Quantitative Analyst: Build algorithms that power automated trading and investment decisions. Salary: ~₹1.3 crore+ per year globally.

- Blockchain Developer: Build cryptocurrency and blockchain solutions. Salary: Highly competitive, often above ₹20 LPA in India.

- Insurance Product Manager: Design and launch new insurance products in FinTech platforms.

- DevOps Engineer: Ensure financial systems run smoothly and securely. Salary: ~₹1.2 crore per year globally.

Why FinTech?

- Cutting-edge technology meets finance

- Startup culture: More flexibility, faster decision-making

- Innovation-focused: You’re building the future of finance

- Attractive compensation: Startups offer competitive salaries + stock options

- Top Companies: Paytm, PhonePe, Razorpay, Stripe (India office)

- Accounting & Audit (The Foundation Skills Everyone Needs)

Accountants are like financial detectives. They ensure every rupee is tracked correctly and companies follow rules.

Common Accounting Roles:

- Accountant: Record financial transactions, prepare reports, ensure accuracy

- Senior Accountant: Supervise junior staff, manage complex accounts

- Auditor: Review financial records to ensure accuracy and compliance

- Tax Analyst: Help clients and companies minimize tax liability legally

Salary Structure:

- Entry-level: ₹2-4 LPA

- Mid-level: ₹4-7 LPA

- Senior-level: ₹7-12 LPA

- Top recruiters: KPMG, Deloitte, ICICI, HDFC, Mahindra, Reliance

Unique Advantage: Accounting skills are universal—you can work in any industry, any country. It’s like having a passport to any industry.