Effective control of debt comprises one of the most basic steps toward building financial security. Now, with a country such as India being highly bounded by personal loans, credit cards, educational loans, and gold loans besides a number of repayments in which there is stress or confusion creeping, or otherwise very poor management of one’s finances. The Debt Consolidation Loans comes in handy for easy relief in bringing various debts into one easy loan. Most of them are highly at reduced interest rates, and there’s only one EMI.

What Are Debt Consolidation Loans?

Debt consolidation loan is that type of finance which allows you to gather all your pending debts together. You don’t need to work on multiple loans with various interest rates and tenures as well as different repayment schedules. For that matter, the debtors can gather all in one loan, more often at a lower interest rate.

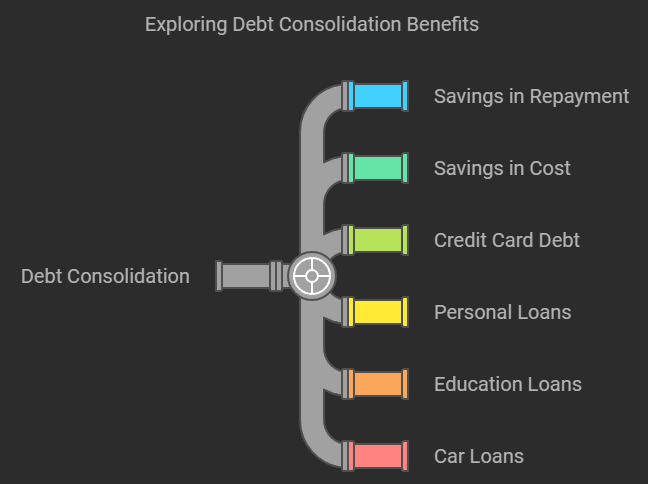

Purpose of Consolidation of Debts

Savings in Repayment: You will have only one EMI every month by merging all the debts.

Savings in Cost: Since you are shifting from those high interest debts like the credit card dues to some loan carrying a lower interest rate that will reduce cost of borrowing.

The credit card has a very high rate between 24 and 36 per cent annually. Credit cards are one of the highest chances of consolidation.

Personal Loan:

Personal loans are generally more expensive than secured loans. It is relevant to include them in consolidation.

Education Loans:

Loans that fall in this category normally have relatively friendly interest rates. One may still consolidate, though, for easy payback.

Car Loans:

It can even be merged while repaying car loan or two-wheeler loans.

How Do Debt Consolidation Loans work in India?

Application: The applicant gets a single loan covering all the debts amount.

Approved and Disbursement: At the time of approval of the loan, the financier disburses the amount in the form of loan given to the borrower or makes a direct transfer to his creditors.

Easy Repayment: The debtor pays now a single EMI payable to the financier rather than multiple creditors.

A borrower with an amount of debt totaling to ₹5,00,000 and divided into three loans: credit card debt 30%, personal loan 15% and education loan 12% can club all this together in one single loan at 11%.

This will bring down the EMI for the month and also the total interest cost thereby making it an easy thing to handle finances.

Benefits of Consolidation Loans

1. Low Interest Rate

Very high rate of inflation is incurred in the form of debt burden on high-interest loans like credit cards.

Low-interest rate loans consolidation, especially when they are secured loans.

| Debt Type | Average Interest Rate in India | Post-Consolidation Rate |

|---|---|---|

| Credit Card | 24%–36% | 10%–15% |

| Education Loan | 10%–13% | 8%–12% |

| Personal Loan | 15%–20% | 10%–15% |

2. Easy Payments

Tracking one EMI will minimize the chances that he would miss his payment, so there would be no chance for penalty or late fees being attracted.

3. Enhanced Credit Score

Regular payments on the new loan increase the credit scores with time. This helps those who want to regain the financial reputation.

4. Debt Settlement Quickly

Low interest rates help in sending a greater percentage of each EMI towards paying off the principal and thus help in debt getting eliminated sooner.

5. Less Stress related to Financial Management

Multiple debts with different terms create so much stress in managing it. One repayment schedule makes all vagueness disappear, thus decreasing the amount of stress.

Debts Consolidation Loan Disadvantages

Although Debt Consolidation Loans have many benefits, they are not devoid of risk:

1. Long Loan Tenure

Longer tenures will actually increase the total amount of interest though consolidation loans may help to reduce your monthly EMI.

2. Processing and Foreclosure Fees

Indian lenders generally charge processing fees of 1%–3% and foreclosure penalties of 2%–5%. Those costs have to be incorporated.

3. Probability of Collateral Based Default on Secured Loans

For home loan and gold loan over-draws, defaults mean one is losing some extremely high-value assets.

4. Expected Debt Cycle

Deemed as new debt, debt consolidated if they have no control over their debt-prone activities and may even lead to higher debt.

Debt Consolidation Loans in Indian Context

Indian context has been able to offer solutions through conventional as well as advanced techniques and tools, as mentioned above:

1. Personal Loan for Debt Consolidation

Slightly easy access without time-consuming processing

Recommended for: Home loan availers, good credit scorer

2. Top-up on home loan

Characters: Home loans with interest rates lesser than personal loans.

Best For: Home loan borrowers who are good EMIs payers.

3. Balance Transfer Credit Cards

Features: Deals such as 0% interest for a few months.

Best For: Short term credit card debt consolidation.

4. Gold Loans

Features: Loans on gold security at low interest rates.

Ideal For: Individuals with gold assets and need loans at low interest rates.

5. NBFC Loans

Features: Flexible credit terms and easy disbursal.

Suitable For: People with a good credit score, but who will not get bank loans.

Things to Note Before Choosing a Consolidation Loan

1. Your Credit Score

Indian lenders demand that a CIBIL score of 700 be maintained by the consolidation unsecured loans applicants.

2. Tenor and Interest Rates

Compare and contrast the interest rate and term of the new loan with your debts. Savings have to be warranted by switching.

3. Processing and Other Charges

Add up all the expenses such as processing charges, foreclosure charges, and charges for late payments to estimate the effective cost of a loan.

4. Collateral Requirements

If you are contemplating a secured loan, be aware of the risks involved in mortgaging property or gold.

5. Financial Discipline

You can consolidate debt only when you are not piling up fresh loans after restructurings.

Case Study in Practice: Practical Scenario

Priya is marketing executive: Her current outstanding were as follows:

Overdraft credit card debt, which had an interest rate of 30% and is to the tune of ₹1,50,000.

Personal loan of ₹2,50,000 with 18% interest

Education loan of ₹1,00,000 at 12% interest

Total burden of Monthly EMI was ₹35,000.

She took a secured Debt Consolidation Loan of ₹5,00,000 at 12% interest for five years. Her new EMI came down to ₹11,122. She saved ₹23,878 in monthly outgo and consolidated her finances.

Debt Consolidation Loans in India

If a Debt Consolidation Loan is not available, there are these:

1. Snowball or Avalanche Repayment Methods

Pay the smallest debts first (snowball) or the one with the highest interest (avalanche) and continue paying minimum installments on others.

2. Negotiation of interest rates with creditors

Few creditors will agree to negotiate interest rates or terms of repayment for failing borrowers.

3. Counseling on debt

In addition, there are many groups in India that provide advice regarding debts to the borrowers to help them prepare for the appropriate repayment scheme.

Frequently Asked Questions about Debt Consolidation Loans in India

1. Do All Borrowers Get Debt Consolidation Loans?

Most lenders insist on a good credit rating but secured loans have relatively fewer requirements.

2. Debt consolidation vs. debt settlement

Debt consolidation consolidates existing debts fully on new terms, whereas debt settlement endeavours to settle the amount received with creditors at a reduced amount.

3. Is DCL accessible to working professionals?

Yes, most lenders advance loans to working professionals against papers for income and credit scores.

Conclusion: Is Debt Consolidation Right for You?

Consolidation loans can be a very powerful tool for streamlining debt management and reducing financial pressure, hence rebuilding credit. However, they require careful planning, disciplined financial behavior, and a thorough assessment of all costs involved.

Debts can make debtors right choices that pave way towards financial freedom if its pros and cons are to be understood, along with choices open to India. A Debt Consolidation Loan is more than just another kind of monetary product – atleast a small step towards an economically bright future, so long as the same is handled judiciously.