Many people finance their needs by choosing personal loans vs credit cards when a financial need has occurred or preparation for some major expense. Both are known sources of funding, but each has its structure and prefers certain financial requirements and able to make the right choice, it’s pretty essential to understand how they work, the benefits of using one as opposed to the other, and the specific situation where one is more valuable than the other. So, let’s take an in-depth look at personal loan vs credit card.

What is a Personal Loan

A personal loan is an unsecured loan which enables the borrowers to collect a sum amount payable in fixed installments over a specific period. Personal loans are taken for various purposes, such as debt consolidation, renovating the homes, medical emergency, or even for a wedding. Since personal loans are unsecured, there is no collateral requirements, but the majority of the process of approval depends on one’s credit score and financial history.

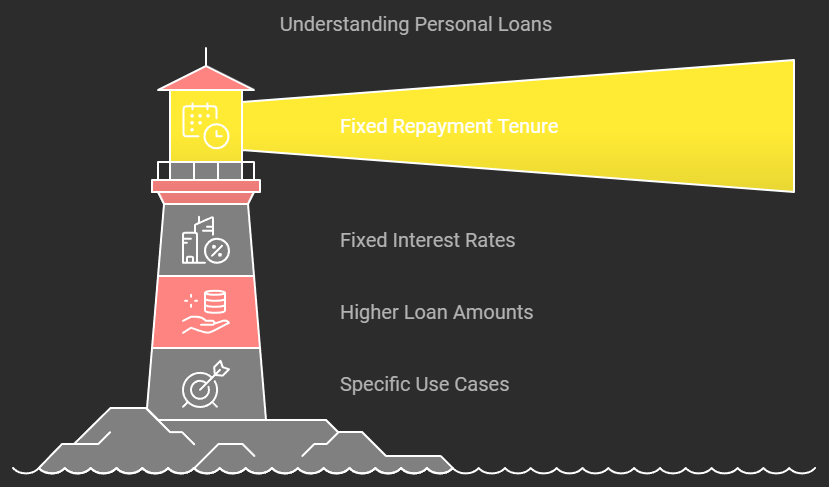

Key Features of Personal Loan

Fixed Tenure of Repayment: A personal loan typically has a fixed tenure, which could be between a few months to a number of years.

Fixed Rate of Interest: Mostly, here comes fixed interest for personal loans and so the monthly installments are known.

Huge Amounts Available: Usually, a person can borrow more sums than on credit cards.

Specific Use Cases: While they offer flexibility, personal loans are often used for significant or planned expenses.

What is a Credit Card

A credit card, on the other hand, is a type of revolving credit, which provides users with a borrowing capacity up to a certain pre-approved limit. Credit cards are used for day-to-day expenses, emergencies, or even small purchases. Unlike personal loans, where one gets the amount in advance, Credit card gives you the continuous flow of credit as long as one stays below the limit and makes minimum monthly payments .

Primary Features Credit Cards :

Revolving Credit: You borrow, pay and then continue borrowing up to the specified credit limit.

Interest-Free Period: Many Credit cards offer interest free period between 20-50 days if total balance is paid before due date on most of the credit cards.

Reward Programs: There are many more advantages associated with the credit card, such as cash return, rewards points, or discount on a particular category.

It will be highly charged and might add up quickly in case the balance of the credit card is not paid completely in one instance.

Personal Loan vs Credit Card – Key Differences

The difference between personal loans and credit cards becomes essential in order to select the right financial tool. Here’s a summary of distinctions between them:

1. Interest Rates

Personal loans have relatively lower interest rates than credit cards. They are therefore better for major or long-term expenditure.

Credit cards attract higher rates of interest, but you never have to pay the high-interest rate if you clear your full balance before the no-interest period has ended.

2. Amount borrowed

A personal loan gives you some upfront sum of money to withdraw.

Credit cards would be best for petty or small reoccurrence and recurring expenditures since the credit limit will not be able to sustain large expenditures.

3. Repayment Flexibility

Personal loans enable one to pay a given amount every month for a given period, which makes budgeting easier.

Credit cards offer flexibility, but if one fails to pay the amount due in total, then heavy surcharges on interest are incurred.

4. Fees and Charges

Processing charges on a personal loan are one time in nature whereas, with a credit card, one has to pay annual fees, late payment penalties and interest on carried balances.

Advantages of a Personal Loan

Personal loans have been found more appropriate for specific financial requirements. Some of the major advantages are as follows:

1. Repayment Schedule

Personal loans provide a relatively predictable payment schedule where one knows exactly how much one has to pay to the bank on a monthly basis. This predictability aids in controlling finance.

2. Lesser Interests

Personal loans also have interest rates much lower than that of credit cards, and therefore, are only suited for a scenario where one would like to consolidate debts that have high interest rates or large projects.

3. Repayment Discipline

The personal loan presents a disciplined behavior through fixed payments and a predetermined closure date.

Advantages of a Credit Card

Credit cards are very versatile and handy to use, and there are many rewards that are found to be more useful for daily expenses:

1. Ease and ease in accessibility

Credit cards are widely accepted; one can utilize the same for online transactions that require instant or recurring costs.

2. Rewards and facilities

From cashback offers to travel miles, credit cards come with attractive reward programs that add value to your spendings.

3. Safety Fund

Credit cards act like a handy backup in emergencies, providing instant access to funds without needing to obtain sanction.

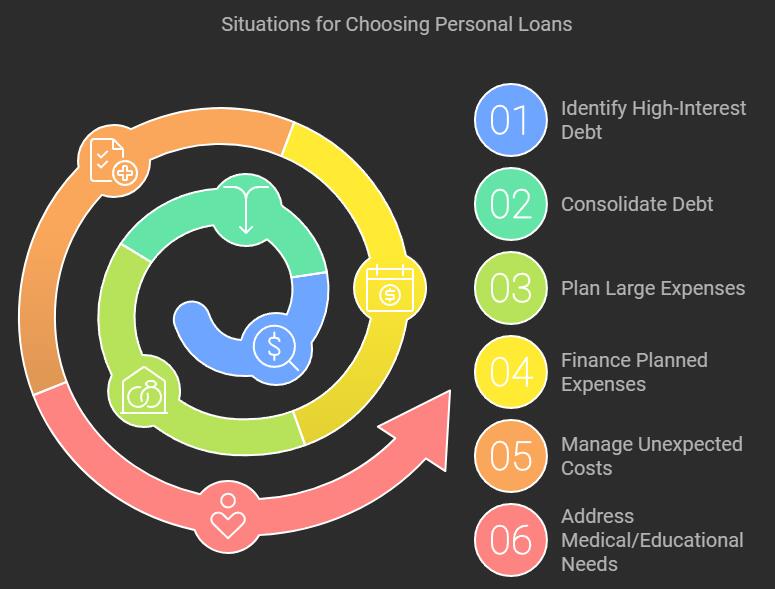

Situations to Choose Personal Loan vs. Credit Card

To decide between a personal loan vs credit card, consider the purpose of the funds and your financial circumstances.

When to Consider a Personal Loan:

Combining high-interest debt into a single payment

Such significant, planned expenses as weddings or home improvements

Managing unexpected medical or educational expenses.

When to Consider a Credit Card:

Making short-term or small-scale purchases.

Benefiting from reward programs for frequent purchases

Tackling emergencies that demand quick money.

Personal Loan vs Credit Card: How to Decide

The choice depends upon your goals and paying power, along with the type of urgency in the demand. Here are questions you may ask your self

- Do I need cash for a large sum at one time or from time to time?

- Can you pay back the borrowed amount within a short period of time to avoid massive interest charges?

- Do your needs form a one-time cost or recurring cost?

You will be able to realign your choice with the financial product that best suits your needs by analyzing your situation.

The Overuse of Credit Options

Be it a personal loan or a credit card, responsible use is essential. Poor management leads to:

That crucial interest payments, especially a credit card

Your credit score declines if you do not pay.

Accumulation of debt and financial stress for the long term.

Factors to Evaluate Before Choosing Personal Loan vs. Credit Card

To make a proper choice you must consider what affects how these credit facilities are going to impact your finances. Some other points are reflected below.

1. Purpose for Borrowing

The purpose of your loan is the first and foremost reason whether a personal loan or credit card fits.

Personal Loan: Suitable for planned, high-ticket expenses like home improvement, buying costly equipment, and even consolidating debts. Personal loans provide a planned one-time solution.

Credit Card: Best for surprise, everyday expenses or emergencies. For example, you would want to use your credit card if you were desperate to book a flight at the last minute or for repairing something urgently.

2. Discipline with finances

The ability to deal with your finances and make scheduled repayments will also determine your choice.

Personal Loan: It encourages financial discipline as there is a structured repayment tenure. It would bring penalty charges for missing payments but at the same time has a defined end date.

Credit Card: There is a need to exercise self-control as on swiping the card, money just gets spent. Outstanding balance carries high interest and debt creation spins.

3. Loan Tenure vs Running Credit

Deciding among loans often depends on how long one will require the borrowed sum of money.

Personal Loan: With tenure-bound repayment makes it a great choice for those who want a clear-cut financial plan. Typical tenures of this loan range from 1 to 5 years.

Credit Card: It is a revolving credit facility, thus continuously providing access to the funds. This will be suitable for someone requiring small amounts intermittently but repaying the same quickly.

4. Credit Score Impact

Both of them impact your credit score in a different way.

Personal Loan: If you pay your installments on time, a personal loan will be positive to your credit score. This demonstrates to the creditors that you are able to afford to take structured debt seriously.

Credit Card: A credit card is putting pressure on your score based on your credit utilization ratio. Using the card up to its limit or making late payments will definitely lower your credit score. On the other hand, keeping a low utilization ratio and paying off your balances boosts your creditworthiness.

5. Emergency Preparedness

Emergency requires quick access to funds.

Personal Loan: Application and approval for personal loans might take a couple of days to be processed hence not ideal for emergencies.

Credit Card: The advantage is instant access to credit limit that can cover unexpected expenses like doctor’s bills or breakdowns of the car. It becomes a strain on finances & service with a high balance after the emergency

6. Tax Advantages

Borrowing may have tax benefits through certain personal loans.

Personal Loan: If you sign up for the loan to renovate your house, then you are entitled to avail tax benefits under the provisions relevant to housing loan taxation in some countries.

Credit Card: Credit cards do not normally give a tax benefit. The high interest charges accumulate costs if the amount outstanding is not paid off.

| Aspect | Personal Loans | Credit Cards |

|---|---|---|

| Number of Accounts | Personal loan accounts have seen steady growth, reaching 40.1 million in March 2023 | The total number of credit cards in circulation in India reached 97.9 million as of December 2023 |

| Growth Rate | Personal loans grew at a compound annual growth rate (CAGR) of 23% from FY18 to FY23 | Credit cards experienced a growth of 16.71 million new cards in 2023, a 77% rise since 2019 |

| Average Loan Size | ₹2.5-5 lakhs for personal loans | Credit limits typically range between ₹50,000 to ₹5 lakhs, depending on eligibility |

| Purpose of Usage | Majorly for planned expenditures like home renovation, weddings, or emergencies | Primarily for everyday expenses, e-commerce, and travel-related spending |

| Interest Rates | 10%-24% annually, depending on credit score and tenure | 24%-42% annually on outstanding balances |

| Repayment Terms | Fixed EMIs over a tenure of 1-5 years | Monthly repayments with an option to carry forward balances at high interest |

| Default Rates | Relatively lower compared to credit cards, thanks to structured EMI plans | Higher default rates due to revolving credit |

| Consumer Base | Used across all demographics, especially for high-ticket expenses | Favored by younger demographics and urban consumers for quick credit and rewards |

| Spending Trends | Typically focused on specific needs or emergencies | Credit card transactions in December 2023 were valued at ₹1.65 trillion, showing a 32% YoY growth |

| Approval Time | Generally requires a longer approval process (2-7 days) | Instant approval for pre-approved users |

| Penetration in Market | Increasing in Tier-II and Tier-III cities | Dominant in urban and semi-urban areas |

Real-Life Examples: Personal Loan vs Credit Card

Scenario 1: Consolidation

For example, when you have more than one high-interest credit cards, you are able to consolidate their loans by using a single personal loan at a lower interest and have only one fixed monthly payment. Consolidation this way will make your payoff much easier and also reduce your cost on the debt.

Scenario 2: Everyday Expenses

For your daily expense like grocery or electricity bill, that credit card is more convenient. Rewards programs can stimulate such usage even more, but you have to settle the outstanding balance every month in order not to pay interest charges.

Scenario 3: Major Purchase or Investment

Do you want to buy that shiny gadget or fund that small business undertaking? Then, you should opt for the personal loan for lump sums at predictable terms

Scenario 4: Unexpected Medical Emergency

Think of a scenario where you have to face a medical emergency. In such cases, credit cards are as good as a miracle as they can give you emergency money without awaiting loan approval.

Debt Management Guidelines

Be it personal loan or credit card, all information to deal with debts is mentioned below:

Budget Review: Always calculate whether you could afford monthly payments before you sign-up for a personal loan or make credit card purchases.

Avoid Impulse Spending: Credit Cards, especially tend to make a lot of people overspend. Try sticking strictly to planned expenses.

Pay More Than the Minimum: For Credit cards always Pay the full balance to avoid interest charges. For Personal loans Consider making additional payments to reduce the tenure.

Shopping Around for the Best Terms: Compare lenders and card issuers for competitive interest rates and lower fees.

Monitor Your Credit: Regularly check your credit score to ensure you’re on track and make improvements where necessary.

The Role of Financial Goals

This also includes guiding your decision based on your long-term financial objectives.

Building Wealth: If you are focused on creating a great life of financial stability, then a personal loan might be more viable for consolidating debt or placing a required investment into self-improvement, such as education.

Convenience at a Short-Term Level: If you require flexibility, then it can be availed easily because the usage of it does not tie you to a set repayment schedule.

Personal Loan Vs Credit Card: A Fit to Your Lifestyle

Your lifestyle ends up becoming the determining factor, or rather, whether these finance tools suit your lifestyle or not.

Frequent Traveler: Credit cards offering cashback on bookings or reward offers are an absolute delight for a traveler.

Planners: For those who can plan their finances and like to know the amount of payments, your personal loan seems to be the best option.

Conclusion: Personal Loan vs Credit Card

Both personal loans and credit cards prove to be very useful, but both are suited for different situations. Personal loans would be helpful in covering major planned expenditures with the lowest interest rate having fixed repayments; on the other hand, credit cards with flexibility and rewards are suitable for recurrent small expenses or crisis-oriented expenditures.

An understanding of one’s needs and repayment capacity should guide one to the right choice in this debate between personal loan and credit card. Thus, always make comparisons regarding interest rates, terms, and conditions before committing to any financial product that would be in accord with having financial health and aligning with long-term goals.

Written By – Ravi Teja