One of the most important decisions you will have to make when taking a loan is whether to go for a fixed-rate vs variable-rate loan. Both types of loans have their own pros and cons, and your decision will make a huge difference in your financial life. Let’s break down these loan types, their features, and which one might be better for you in the Indian context.

Fixed Rate Interest Loans

What Are Fixed Rate Loans?

It has a fixed interest rate whereby at the time of issuance the individual is assured of constant repayments throughout the life period of the loan. Repayment is predictable for which easier budgeting and also free from sudden financial shocks.

Types of Fixed Rate Loans

There are different kinds of fixed-rate loans, which satisfy distinct borrowers.

Home Loans: The borrower expects predictable monthly payments.

Car Loans: Generally fixed rate so that the payback is easy.

Personal Loans: Tenures are shorter, and the rates are fixed.

Education Loans: A few Indian banks provide education loans at a fixed rate so that the student is not burdened by the increase in the rate.

Advantages and Disadvantages of Fixed Rate Loans

Advantages:

Predictable Payments: No shocks; your EMIs remain the same.

Protection from Rate Hikes: Market fluctuations won’t bother you.

Budget-Friendly: For long-term planning.

Disadvantages:

Higher Initial Rates: The fixed rate is usually more than the initial variable rate.

No Benefit from Rate Drops: Borrowers miss out on declining interest trends.

Prepayment Penalties: Some lenders impose penalties on early repayment.

Variable Interest Rate Loans

What Are Variable-Rate Loans?

A variable-rate loan is a type of loan, which means its rate keeps changing according to market conditions. Such rates in India usually set relative to a benchmark such as RBI’s repo rate or MCLR, Marginal Cost of Funds-Based Lending Rate.

Types of Variable-Rate Loans

Variable-rate loans are very popular in India as well:

Home Loans: They are mostly opted as the interest rates might go low and one can have a benefit of lower rates of interest.

Business Loans: For these loans, the business organization can manage their cash flows because the interest rates float.

Education Loans: The floating rates are more prevalent in such loans that require more time to pay off.

Pros of Variable-Rate Loans

Lower Primary Rates: They are generally less compared to fixed-rate loans.

Enjoy Rate Cuts: When the interest rates fall, the EMIs reduce.

Potential for Long-Term Savings: Over time, borrowers may pay less interest.

The Cons of Variable-Rate Loans

Unpredictable Payments: Monthly payments can fluctuate, making budgeting difficult.

Risk of Rate Hikes: Rising rates increase EMI amounts.

Financial Stress: Rate increases can strain finances unexpectedly.

Adjustable – Rate Mortgages (ARMs)

Adjustable-rate mortgages-the type of floating rate loan-receive an initial fixed rate for some period then float. In India, this sort of loans is frequently applied by the individuals for house loan along with an opportunity to arrange some future financial adjustment.

Fixed Rate vs Variable Rate Loan: Which Is Better?

Fixed or Variable: Which Rate Is Lower?

Variable rate loans usually start off with lower interest rates than for fixed-rate loans. However, the two may become equalized later on as market conditions change. Although fixed-rate ensures predictability, variable can yield tremendous savings at any time when the rates are cut.

Risks of a Variable Rate Loan

The major risk involved in a variable rate loan is that of market fluctuation. For instance,

When the RBI increases the repo rate, then the lenders increase the floating interest rate, and thus EMIs are increased.

Prolonged rate hikes, this may lead to financial stress or loan default.

A borrower has to be aware of his risk tolerance and sustainability while choosing this loan to withstand the fluctuation of rates.

Loan Rates and Global Market Impact

Global economic factors such as changes in U.S. Federal Reserve policies or geopolitical events may indirectly influence Indian loan rates. For instance, the confidence of foreign investors in Indian markets may influence the liquidity available to banks, which in turn may influence both fixed and floating loan rates.

RBI Monetary Policies

The RBI periodically changes interest rates as per the economic indicators:

Accommodative Stand: Lending is encouraged with lower repo rates, which benefits floating-rate borrowers.

Tight Monetary Policy: This discourages excessive borrowing because of high repo rates, making variable rate loans costlier.

How Do I Choose Between a Fixed Rate and a Variable Rate Loan?

Purpose of the Loan

The choice often depends on the purpose of the loan:

For long-term loans like home loans, you can save money if you are able to bear market fluctuations at variable rates.

For short-term loans such as personal loans, fixed rates provide predictability.

Interest Rates

High Rate Environment: Choose a fixed-rate loan to secure rates before they rise again.

Low Rate Environment: An adjustable rate loan allows the consumer to take advantage of additional potential rate cuts in the future.

Do Variable Rates Ever Decrease?

Yes, they do Floating rates reduce in India when RBI lowers the repo rate or the banks decrease the lending benchmark. Recently, lower floating rates are also because of recent reductions in repo rates. With the low rates, banks are no more reluctant to change the status for the borrowers.

Can I Switch from a Variable Rate to a Fixed Rate?

Options for Flexibility to Change

Many Indian banks have the facility of switching from fixed to floating and vice versa. However, it is a process that involves:

Conversion Fees: Usually 0.5%–2% of the outstanding principal amount.

Documentation: Updating the loan agreement with new terms.

Switching may be useful if market conditions change drastically. For example:

Moving to a fixed rate when variable rates are likely to increase

Switching to a floating rate during a period of falling interest rates

Select the Best Loan for You

Here are some tips to help you decide:

Assess Your Risk Tolerance: If you are very risk-averse, prefer a fixed-rate loan; if you are comfortable with your market risks, you may actually save money with a variable-rate loan.

Consider Loan Tenure: Long-term people may be better off with floating rates, while short-tenure commitments are taken care of with fixed rate.

Compare Offers: Do online loan calculations and compare offers from banks.

Case Study: Indian Borrowers’ Preferences

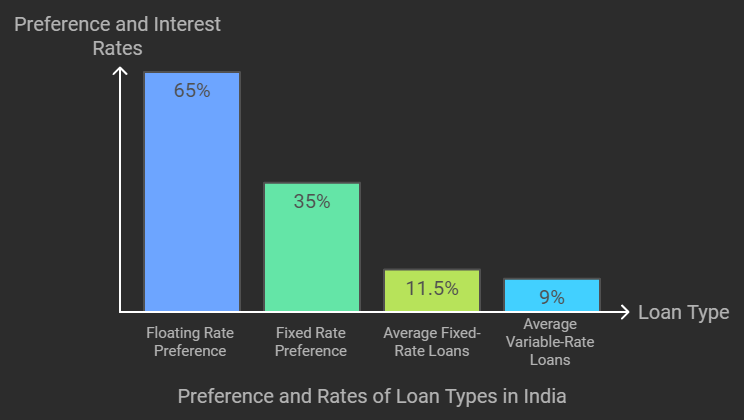

A study by CRIF High Mark 2023 said:

65% of Indian borrowers of home loans prefer a floating rate.

35% have a preference for fixed rate, mainly for personal loans and auto loans.

Statistical Analysis: Fixed against Variable Rates in India

Fixed-rate loans: an average of 10.5%–12.5% (personal loan, as of 2024).

Variable-rate loans: average of 8.5%–9.5% (home loans linked with repo rate).

Real-Life Examples of Borrowers’ Choices

Example 1: Fixed Rate for Stability

Rajesh, a salaried employee with a stable monthly income, chose a fixed rate home loan to provide steady EMIs throughout his loan term of 20 years. He was willing to forgo savings from possible cuts in the interest rate in the future.

Example 2: Variable Rate for Flexibility

Priya, a freelancer with fluctuating income, chose a variable-rate personal loan. She benefited from lower interest rates during the economic slowdown and made part-payments when her income was high, reducing her overall interest burden.

Additional Hidden Costs to be Aware Of

Fixed-Rate Loans

Higher Early Payment Penalties: For fixed loans, prepayment penalty is pretty steep, and that would defeat the savings of paying off early.

Processing Fees: Fixed rate loans sometimes attract higher processing fees as compared to floating rate loans.

Variable Rate Loans

Reset Clause: Most of the floating rate loans contain a reset clause where the bank may modify the interest rate time-to-time. This is often prejudicial to the interest of the borrower.

Lack of Transparency: In this case, borrowers will not know how changes in MCLR or repo rates influence their EMIs. Their cost of credit is raised unexpectedly.

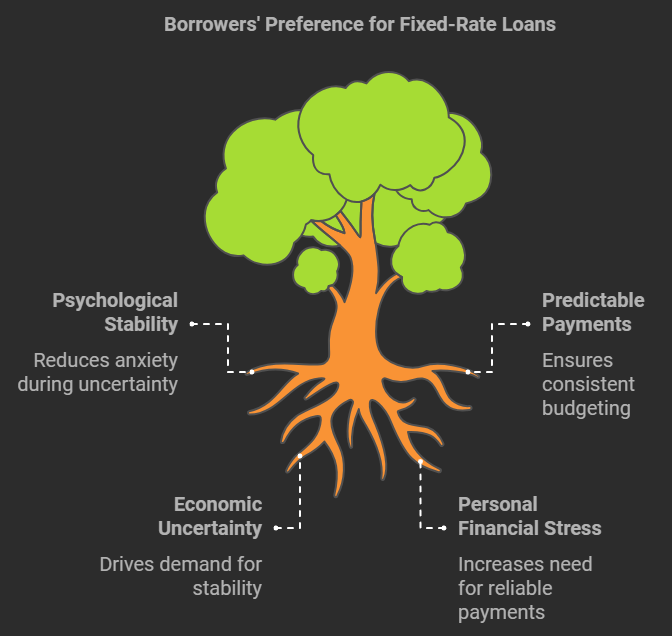

Behavioral Aspect of Borrowing

Psychological Safety of Fixed Rates

Borrowers often prefer fixed-rate loans for the peace of mind they offer. Knowing your monthly EMIs won’t change provides psychological stability, especially during uncertain times, such as global economic slowdowns or personal financial stress.

Risk Appetite and Financial Literacy

Choosing a loan also depends on the borrower’s risk tolerance:

Low Risk Appetite: Fixed-rate loans offer predictability and are suitable for individuals with conservative financial habits.

High Risk Appetite: Variable-rate loans are ideal for a financially savvy and market-fluctuation-willing borrower.

Conclusion: Fixed-Rate vs Variable-Rate Loans

Go Fixed If:

- You value predictability.

- Rates are going up.

- You have low risk tolerance.

Choose Variable If:

- You can live with the market changes.

- Rates are going down.

- You are going to be in the loan for a while.

Remember, the “best loan” is that one which best aligns with your financial goals, risk appetite, and market conditions.

The right choice between a fixed-rate loan and a variable-rate loan in India requires serious thinking. Read this guide to take a well-informed decision as per your needs. Never fail to get your own financial advisor to suit the need; keep track of the trend in interest rates for optimal saving. Fixed rate vs variable rate loan—now you know which might work better for you!