What is Mortgage?

Mortgage is known in common law jurisdictions by the name of hypothec loan. Here, persons wishing to acquire or having properties use the loan to finance, thereby placing a charge on the property, with a mortgage originating as security for the loan, giving the lender the power to foreclose or repossess the property should the borrower default. The word “mortgage” is derived from the Law French.

What is Mortgage Refinancing?

Mortgage refinancing is the process of replacing your old mortgage by a new loan, usually with different terms. When one refinances, the new mortgage pays off the old one, and you then begin paying for the new loan. People refinance their homes for all these reasons-to get a lower interest rate, lower their monthly payments, switch from an adjustable-rate to a fixed-rate mortgage, or change the term of the loan, such as switching from a 30-year loan to a 15-year loan.

Tips To Know Before You Refinance Your Mortgage

1. Your Home’s Equity

If your home depreciates after you get a mortgage It’s also not wise to refinance your mortgage.

In the fourth quarter of 2022, U.S. homeowners Mortgage equity rose 7.3% year-over-year, totaling $1 trillion. Average EPS per borrower was $14,300. The number of homeowners in negative equity decreased 2%. Some homes still haven’t regained their value. This makes it difficult to refinance short-term stocks. For those who have little capital Government programs can provide a solution. Homeowners with at least 20% equity are more likely to qualify for the new loan.

2. Your Credit Score

Knowing your current credit score will be important. Having a good credit score is crucial for qualifying for the best mortgage interest rates. Lenders have become more strict with their qualification standards. Even individuals with high credit scores may not qualify for the most favorable rates. A score of 750 or above is typically needed for the best rates, while lower scores may result in higher interest rates or fees.

3. Your Debt-to-Income Ratio

Lenders have raised credit score and debt-to-income ratio requirements for getting a new mortgage. Higher income, job stability, and savings can help qualify, but lenders usually cap housing payments at 28% of gross income. Aim for a DTI ratio under 36%, but some lenders accept up to 43% with positives. Settle debts before refinancing.

Before refinancing, it might be necessary to settle some debts in order to be eligible.

4. The Costs of Refinancing

When refinancing a mortgage, it typically incurs fees ranging from 3% to 6% of the entire loan amount, however, borrowers have various options to minimize these expenses (or include them in the loan).

If you have sufficient equity, you have the option to add the costs to your new loan, thereby boosting the principal. Certain lenders provide a refinance option without any costs involved, typically achieved by increasing the interest rate slightly to account for the closing expenses.

Remember to haggle and compare prices, as the lender may cover or decrease certain refinancing charges.

5. Rates vs. the Term

Though many focus their efforts on the interest rate, finding your goals for refinance will help you determine which mortgage product is best suited for your needs. For example, if you need to have the lowest monthly payments possible, you would look for that loan with the lowest interest rate and the longest term available.

Reduce the interest payments over time by finding the lowest interest rate for the shortest period. Those seeking to quickly repay their loan should seek a mortgage with the shortest term that fits within their budget. A mortgage calculator can display how various rates affect your monthly payment.

6. Your Taxes

A lot of customers depend on the mortgage interest deduction to decrease their tax payment. Refinancing has the potential to decrease interest payments, leading to a reduction in deductions. At first, interest deduction could be greater because of the higher percentage of interest in the payments. Expanding loan amount for cash out or closing expenses impacts overall interest amount paid. Refinancing is usually not the preferred option for balancing tax deductions.

7. Private Mortgage Insurance

Homeowners with less than 20% equity in their home during a refinance must pay private mortgage insurance (PMI). Those already paying PMI won’t be affected. Some homeowners with decreased home values may now have to pay PMI. Refinancing may not significantly reduce payments enough to offset PMI costs, which lenders can calculate quickly.

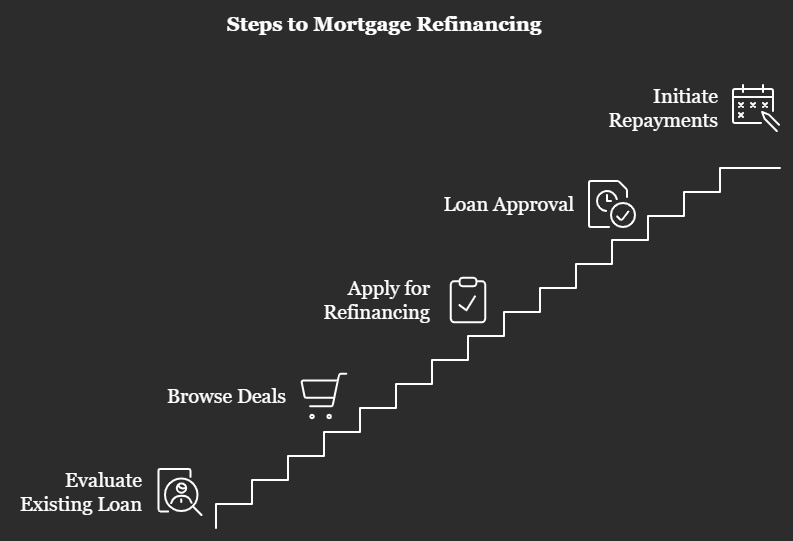

Process of Mortgage Refinancing

Evaluate Your Existing Loan: Familiarize yourself with your current terms, outstanding principal amount, and total interest already paid.

Browse deals: Evaluate mortgage refinance rates from different banks. Choose lenders offering competitive interest rates for home loans and favorable terms.

Apply for Refinancing: Make sure you have all required documentation ready, including income proof, property papers, and information about your existing loan. You can consult the IIFL Home Loan papers and requirements to make sure you have all the necessary items.

Loan Approval: Once the lender assesses your application, they will approve the new loan if you satisfy their eligibility requirements. The remaining amount from your first mortgage will be settled and you will begin to repay the new loan according to the revised conditions.

Initiate Repayments: Commence repayment of the newly acquired loan. Utilize the Home Loan EMI calculator to get an idea of your updated monthly payments and organize your finances accordingly.

Is Mortgage Refinancing Right for You?

Mortgage refinance can save some dollars for many of the homeowners while being a means to positive improvement in financial stability, but it does not go to mean that it works the best for all, especially those nearing the end of loan term or planning to move soon. Those looking for better terms or lower EMIs should consider refinancing wisely.

Conclusion

Mortgage refinancing can be an extremely valuable component of your finances, but is never a one-size-fits-all cure-all. Should you know your objectives, improve your financial condition, work out the break-even point, and compare various loan terms, you can now conclude with an informed decision. Stay away from pitfalls and time it right so you can cash in on the maximum benefits from refinancing easily.

To read more blogs CLICK HERE